Back to: AGRICULTURAL SCIENCE SS2

Welcome to Class !!

We are eager to have you join us !!

In today’s Agricultural Science class, We will continue learning about Farm Records and Accounts. We hope you enjoy the class!

DEFINITION OF SOME ACCOUNTING TERMS

- Farm Asset: This is anything of value in the possession of a farm business, There are two types;

- Fixed Assets: These are assets which are not used up during production. Examples are; landed property, farm building, motor vehicles, tools and implements, incubator and milking machine

- Current Assets: These are assets which are used up during the process of production eg water, feed, drugs, chemical, fertilizers, seeds and cash in the bank.

- Cost: these are expenses made during production. There are two types of fixed and variable cost

- Fixed Cost: This is the component of the total of production cost which does not vary with the level of production e.g. cost of buildings, equipment, machinery, farm structures (Silo, barn, etc.)

- Variable Cost: This is the other component of the total cost which varies directly with the level of production e.g. wages, salaries, cost of seeds, cost of fertilizer, cost of agrochemical etc.

- Liabilities: This is the money owed to external persons or corporate bodies e.g. loan to banks. The two types are;

- Current or short term liabilities: These are debts that must be paid back within one accounting year

- Long term liabilities: These are debts that cannot be paid within an accounting year

- Net Capital, Net worth or owner equity: This is the total amount of money supplied by the owner of the farm business.

Asset – Liability = Owner’s Equity or Capital

4. Liquidity is the ability of a farm business to meet its financial obligations as they fall due. It is the ease at which farm asset can be covered to cash.

- Solvency: This is the ability of the farm business to cover its liquidation of the asset. A business is solvent if the sale of its assets would be sufficient to pay off all debts

- Appreciation: This is the increase in the value or worth of an asset as the asset is being used over time. Examples of assets that can appreciate are; growing animals, cash crops, land etc.

- Depreciation: Depreciation refers to the loss or reduction in the value or worth of an asset as the asset is being used over time

- Salvage Value: This is the amount at which an asset is sold off when it is no longer economical to keep, or when the cost of maintenance is too high

- Useful life Span: This means the number of years a piece of farm equipment can effectively serve the farmer.

EVALUATION

- Define the following: (i) Appreciation (ii) Solvency (iii) Liquidity

- Distinguish between fixed assets and variable assets.

Calculations of Depreciation and Salvage Value

The formula for calculating depreciation is as follows,

- Total depreciation = cost price of an asset – salvage value of an asset

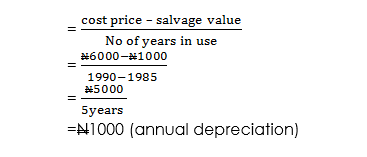

- Annual depreciation =

Example: A plough was purchased in 1985 at the cost of N 6000 and sold off in 1990 at the cost of N 1000

Calculate;

- The salvage value

- Total depreciation

- Annual depreciation

- Appreciation

Solution

The cost price of the plough = N 6000

- Salvage value = N 1000

Lifespan of useful life (1990 – 1985) = 5years

Salvage value = N 1000 i.e. the price at which it was sold off

- Total Depreciation = Cost price – salvage value

= N 6000 – N 1000

= N5000

- Annual Depreciation

- There is no appreciation

CLASS ACTIVITY

Answer questions 3, 4, 6 and 9 from Essential Agricultural science on Page 448.

GENERAL EVALUATION

- What are farm records and account?

- List five importance of keeping farm records and accounts.

- List five types of farm account.

- Distinguish between fixed and variable cost.

READING ASSIGNMENT

- Essential Agricultural Science for Senior Secondary School by O.A. Iwena Chapter 48 pages 440-449

- Answer the following questions from WAEC PAQ 1989 theory question 10, 1993 theory question 10, 1996 theory question 10, 1997 theory question 10, 1998 theory question 10, 2013 theory question 9 & 10, 2009 theory question 9 & 10, 1999 theory question 9, 2006 theory question 9 and 2007 theory question 9

THEORY

- What is a profit and loss account

- List five types of farm records

- What is farm asset

- Distinguish between credit and subsidy

We have come to the end of this class. We do hope you enjoyed the class?

Should you have any further question, feel free to ask in the comment section below and trust us to respond as soon as possible.

In our next class, we will be learning about Animal Nutrition. We are very much eager to meet you there.