Back to: FINANCIAL ACCOUNTING SS1

Welcome to class!

In today’s class, we will be talking about the balance sheet. Enjoy the class!

The Balance Sheet

/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

CONTENTS

- Meaning of the Balance Sheet

- The layout of the Balance Sheet

- Definition of terms/contents of the Balance Sheet

The Balance Sheet is a statement of the financial position of a business on a certain date. It shows the assets, liabilities and the capital of the business in a well-arranged form.

Unlike a Trading, Profit and Loss Account, a Balance Sheet is not part of the double-entry system. After the nominal account balances have been transferred to the Trading and Profit and Loss Account, the only balances left in the ledger are those for assets and liabilities. The Balance Sheet is a list of these balances.

Although a Balance Sheet is not an account, The Trading and Profit And Loss Account and the Balance Sheet are known collectively as the final accounts of a business.

The layout of the balance sheet

The Balance Sheet is prepared by listing and grouping the assets and liabilities of the business under appropriate headings as below:

Fixed Assets

Current Assets

Current Liabilities

Long – term Liabilities

Capital

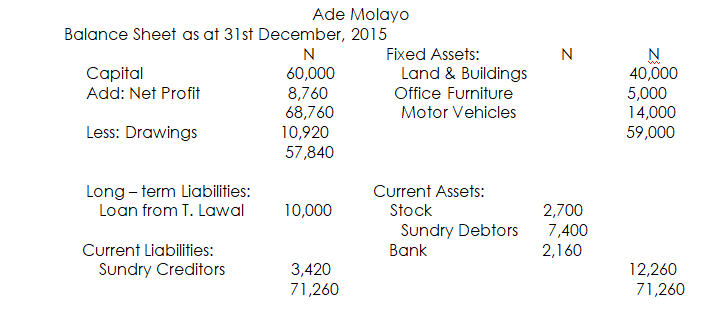

Using the illustration worked out in the last example, the Balance Sheet will be as shown below:

- A Balance Sheet is a ‘position’ statement showing the position of a business at a particular date. It is not a ‘period’ statement like a Trading and Profit and Loss Account.

- The fixed assets are listed in order of permanence. The order is:

Land and Buildings

Plant and Machinery

Furniture and Fittings

Equipment/ Tools

Motor Vehicles

- The current assets are listed in the reverse order of realisability i.e. the ease at which they can be converted to cash. The order is:

Stock

Debtors

Bank

Cash

- The total of the fixed and current assets N(59,000 + 12,260) less the total of the current and long – term liabilities N(3,420 + 10,000) equals the closing balance on the Capital Account N57,840. This demonstrates the accounting equation i.e. assets – liabilities = capital

- At the end of the year, the balances on the Profit and Loss Account and Drawings Account are transferred to the Capital Account (by Journal entries). However, the details are still shown in the Balance Sheet to show how the closing capital is arrived at.

Evaluation

- Simplified and Amplified Financial Accounting. Exercise 1 & 2

- Simplified and Amplified Financial Accounting. Exercise 3,4 & 5

Definition of balance sheet items

- Assets: These are the resources, properties or possessions owned by the business as well as what other people or firms owed the business. Examples are Land and Buildings, Motor Vehicles, Furniture, Equipment, Machinery, Tools, Stock, Cash at hand, Cash at Bank, Debtors etc. Assets can be divided into fixed assets and current assets.

- Fixed Assets are long-lasting assets which are acquired for use rather than for resale. Fixed assets help the business to earn revenue. Examples are Land and Buildings, Plant, Machinery, Motor Vehicles, Furniture, Fittings, Tools, Equipment etc.

- Current Assets are assets which are usually held by the business for a short period of time. They are usually converted from one form to another in the course of business. Current assets are either in the form of cash or can be turned to cash relatively easily. Examples are Stock (Inventory), Trade Debtors (or Sundry Debtors), Bank and Cash.

- Liabilities: These are obligations arising from past transactions. It is a claim by outsiders on the assets of the business. Liabilities represent what the business owes other people or firms. Liabilities can be classified as current liabilities and long – term liabilities.

- Current Liabilities are short – term liabilities. They are the amounts owed by the business which are due for settlement (repayment) within the next twelve months (i.e. one year) of the date of the Balance Sheet. Examples are Trade Creditors (or Sundry Creditors), Bank Overdraft etc.

- Long-term liabilities are amounts owed by the business which are not due for repayment within the next twelve months (i.e. one year) of the date of the Balance Sheet. Examples are Long – term loans, Mortgages, Debentures etc.

The Balance Sheet can be prepared in two ways – horizontal format and vertical format. The Balance Sheet earlier prepared for Ade Molayo was prepared in the horizontal format.

The same Balance Sheet prepared in the vertical format is shown below:

Ade Molayo

Balance Sheet as at 31st December 2015

NNN

Fixed Assets:

Land and Buildings 40,000

Office Furniture 5,000

Motor Vehicles 14,000

59,000

Current Assets:

Stock 2,700

Sundry Debtors 7,400

Bank 2,160

12,260

Current Liabilities:

Sundry Creditors 3,420

Net Current Assets 8,840

67,840

Long – term Liabilities:

A loan from T. Lawal 10,000

57,840

Financed by:

Capital at 1st January 2015 60,000

Add: Net Profit for the year 8,760

68,760

Less: Drawings 10,920

57,840

N.B:

- There is only one current liability so this has been shown in the centre column. If there had been more than one they would have been listed in the first column and the total shown in the centre column.

- The main advantage a vertical Balance Sheet has over a horizontal Balance Sheet is that it shows the figure for the net current assets. This is also known as the working capital.

- The long – term liability has been deducted in the first section of the Balance Sheet. Alternatively, it could have been added to the final balance of the Capital Account in the second section of the Balance Sheet.

Evaluation

- Simplified and Amplified Financial Accounting. Exercise 6 and 7X

- Business Accounting 1 Exercise 8.3

Reading assignment

- Simplified and Amplified Financial Accounting Page 188 – 196

- Business Accounting 1 Page 58 – 71

General evaluation

- Business Accounting 1, Exercise 8.4, 8.5Aand 8.6A

- Simplified and Amplified Financial Accounting. Questions 5X, 6, 7X and 8X

Weekend assignment

- Assets minus liabilities of a business always give (a) profit (b) bank balance (c) capital (d) drawings

- Debentures is classified as (a) capital (b) fixed assets (c) short – term liability (d) long – term liability

- Which of the following is added to the proprietor’s capital (a) net profit (b) gross profit (c) net sales (d) gross sales

- Which of the following is not part of the double-entry system (a) Trading Account (b) Profit and Loss Account (c) Balance Sheet (d) Cash Book

- Which of the following statements is not correct (a) profits increase capital (b) losses reduce capital (c) drawings reduce capital (d) drawings increase capital

Theory

- Mention a class of account that will always show :

- debit balance

- credit balance

- Explain the following: (a) fixed assets (b) current assets (c) current liabilities (d) long – term liabilities (d)

In our next class, we will be talking about Opening Entries and Recording of Subsequent Financial Transactions. We hope you enjoyed the class.

Should you any further question, feel free to ask in the comment section below and trust us to respond as soon as possible.