Back to: ECONOMICS SS3

Welcome to class!

In today’s class, we will be talking about the deficit balance of payment. Enjoy the class!

Deficit Balance of Payment

BALANCE OF TRADE

Balance of Trade – This is the comparison of a country’s total visible exports with her total visible imports. When visible exports with her total visible imports in monetary terms are equal we have Balance of Trade. A positive or favourable Balance of Trade – means that a country is exporting more in monetary terms than it is importing while a negative or unfavourable balance of trade means that a country is importing more in monetary terms than it is exporting.

BALANCE OF PAYMENT

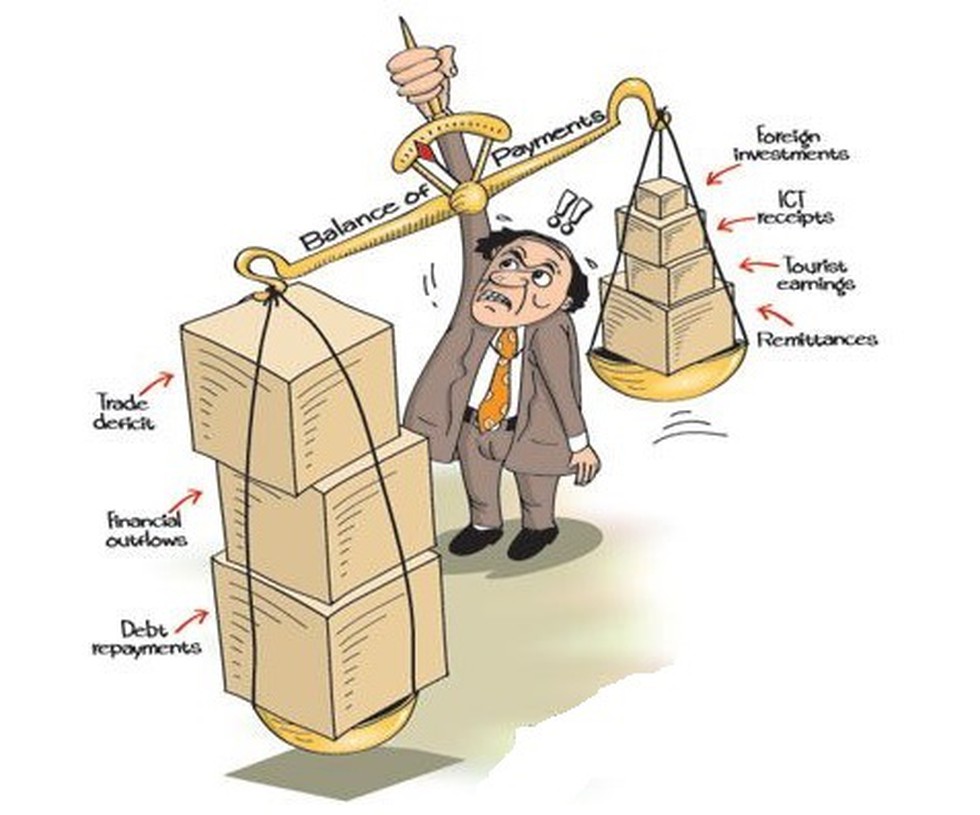

Balance of payment may be defined as a statement or record showing the relationship between a country’s total payments to other countries and its total receipts from them in a year. A country’s Balance of payment is grouped into three parts.

- Current Account

- Capital Account

- Monetary movement Account

- Current Account: The Current Account is made up of receipts and payments for visible and invisible services. The visible comprises tangible products such as cars, computer, clothing materials, electronics etc. While the invisible services are: insurance, banking, transport, interest payment and tourism.

- Capital Account: For a country to set up business in other countries, and for other countries to set up business in its country, there is need for inflow and outflow of capital both in the long and short term; this is contained in the capital account. This is in the form of investments, loans and grants.

- Monetary Movement Account: There is a need for differences in Current Account and Capital Account to be settled. This is done in the monetary movement Account.

TERMS OF TRADE

Term of trade is the rate at which a country’s export is exchanged for her import. It is expressed as a relationship between the prices a country receives for its exports and the prices it pays for import.

Terms of Trade (TOT) = Index of import price x 100

Index of import price 1

The terms of Trade are favourable if the average price of exports is higher than the average price of imports. The terms of Trade are unfavourable if the average import price is higher than the average export price, which results in more expensive import than exports and this situation makes the Terms trade to deteriorate. When the Terms of Trade are unfavourable, the index is less than 100. This will reduce the real national income.

Example

A country’s import price index by 1995 was 50 and her index of export prices was 70. Calculate the terms of trade (UME) 2000.

Solution

The index of Terms of trade;

The price index of visible exports x 100

The price index of visible imports 1

Substitute= 70 x 100 = 140%

. 50 1

The Balance of payment of a country can either be favourable or unfavourable, in most cases it could be balanced. A country’s Balance of payment is said to be favourable when the receipts from invisible and visible export trade become greater than payment to other countries on invisible and visible imports. A credit balance can be used to increase investment or to add to a country’s gold reserve.

In the other hands, unfavourable balance of payment is said to occur when the payments on visible and invisible import are greater than receipts on visible and invisible exports. This is also known as adverse or deficit balance.

HOW TO FINANCE DEFICIT BALANCE OF PAYMENT

Different Options opened to a country seeking to correct her adverse balance of payment. The following options could be considered;

- A country can borrow from foreign financial institutions e.g. World Bank, Paris Club.

- Assistance could be sought from international financial institutions

- Foreign investment could be disposed of to offset the debt (if any).

- Gold could be exported (if any).

- The national economy could be deflated through monetary and fiscal measures.

- Import substitution – This could be in form of curtailment of imports and export stimulation.

- The country’s currency could be devalued, this would encourage export and discourage import.

- Gifts and aids from friendly countries can be used to settle the indebtedness.

- The interest rates can be raised to encourage the inflow of foreign capital.

- Export promotion.

DEVALUATION OF CURRENCY

A country devaluation of the currency is a deliberate policy through which the value of one country’s currency is reduced in relation to other country’s currency. It can also be defined as a fall in the exchange value of a country’s currency in relation to the currencies of other countries.

EFFECTS OF DEVALUATION OF CURRENCY

- The exports of the country whose currency is devalued become cheaper.

- As a reverse to the above, the import too becomes expensive.

- Since the exports become cheaper, more would be sold abroad.

- Balance of payment improvement – as said earlier, when more are sold abroad, foreign exchange accruing to the nation can be used to improve the Bop of the nation.

- There is an increase in the number of industries which will lead to an increase in employment.

CONDITIONS IN WHICH DEVALUATION CAN IMPROVE A COUNTRY’S BALANCE OF PAYMENT

- The demand for import must be elastic. Increase in prices of imports, as a result of devaluation, will lead to a fall in demand for import.

- The country’s export must be elastic i.e. It should be able to respond to foreign demand.

- Other countries must not devalue their own currencies.

- There must be no increase in wages and other incomes.

MATHEMATICAL APPROACH TO CURRENCY DEVALUATION

The rate at which a country exchanges her currency for other countries currencies is known as “Exchange rate”.

Example I

Assuming that Nigeria is willing to buy or sell cocoa at N800 per ton and the USA is willing to buy or sell at $100, then the value of the two currencies can be fixed as ………..

N800 = $100

N8 = $1

Example II

If the exchange rate of naira to the dollar is as follow:

If Nigeria devalues her Currency by 100%, the new exchange will be …. If formerly

N100 = $1

= 100 x 100= N100

100 x 1

N100 +N100 = N200

Hence N200 = $1

ECONOMIC INTEGRATION

Every country in the world strives to achieve economic growth and development. This is better achieved when countries pull their resources together to achieve greater efficiency. This gives rise to Economic Integration. Economic integration may be defined as a form of international cooperation among nations to foster their economic interests. A good example of economic integration in Africa is the Economic Community of West African States (ECOWAS). Other economic integration includes the European Economic Community (EEC), the African Development Bank (ADB), the Chad Basin Commission, and the International Monetary Fund (IMF).

OBJECTIVES OF ECONOMIC INTEGRATION

The following are the objectives of Economic Integration:

- To enlarge market that will encourage large scale production.

- Economic integration enhances efficiency that reflects in production units.

- It enhances greater resources mobility.

- To encourage specialization among countries coming together.

- To empower each country to participate effectively in the world market.

- To create job opportunities.

- To improve the living standard of member nations.

- To accelerate economic development in the region.

FORMS OF ECONOMIC INTEGRATION

- Free trade area.

- Common Market

- Economic union e.g. ECOWAS

- Customs union

PROBLEMS OF ECONOMIC INTEGRATION IN WEST AFRICA

- The smaller countries always nurse fear of big countries’ domination.

- The formula to adopt in sharing the revenue generated by the groups often generate more heat than light.

- Differences in economic and political ideology often make the countries to disagree.

- Member nations speak different languages. This slows down decision making.

- Member nations are unwilling to surrender their sovereignty to bigger countries.

- Frequent changes in the government of member nations often affect decision making.

- Some of the members of economic union e.g. ECOWAS are still tied to the apron of their colonial masters.

- Inadequate capital – e.g. ECOWAS cannot meet their plan due to the fact that some countries within the union could not pay their subscription.

GENERAL EVALUATION

- What is Trade Union?

- Describe any four functions of Trade Union.

- What are Infant Industries?

- Outline four objectives of price control policy.

- Describe three functions of money.

We hope you enjoyed the class.

Should you have any further question, feel free to ask in the comment section below and trust us to respond as soon as possible.