Back to: Pre Vocational Studies JSS 3

Welcome to class!

In today’s class, we shall be talking about packaging criteria. I trust you will enjoy the class!

Meaning and Importance of Bookkeeping

Bookkeeping is the systematic recording of financial transactions for a business or individual. It involves tracking income, expenses, assets, and liabilities to provide a clear and accurate picture of financial health. Bookkeeping is a fundamental aspect of financial management, essential for making informed decisions and ensuring compliance with accounting standards.

Meaning of Bookkeeping

Bookkeeping is the process of:

- Recording Transactions: Accurately recording all financial transactions, including sales, purchases, payments, and receipts.

- Classifying Transactions: Categorizing transactions into appropriate accounts, such as cash, accounts receivable, inventory, and expenses.

- Summarizing Transactions: Summarizing financial data into financial statements, such as income statements, balance sheets, and cash flow statements.

- Maintaining Records: Organizing and storing financial records in a systematic and accessible manner.

Importance of Bookkeeping

- Financial Oversight: Bookkeeping provides a clear and comprehensive view of a business’s financial performance. It helps identify areas of strength and weakness, enabling businesses to make informed decisions and take corrective actions.

- Decision Making: Accurate bookkeeping provides the necessary data for making sound business decisions, such as investment, expansion, or cost-cutting measures.

- Tax Compliance: Bookkeeping is essential for ensuring compliance with tax laws and regulations. Accurate records can help businesses avoid penalties and fines.

- Investor Relations: For businesses seeking investment, well-maintained bookkeeping records can instill confidence in potential investors.

- Lender Relations: When applying for loans or credit, accurate bookkeeping can demonstrate financial stability and increase the chances of approval.

- Fraud Prevention: Bookkeeping can help identify and prevent fraudulent activities by maintaining a clear audit trail of financial transactions.

- Business Planning: Bookkeeping provides the data needed for creating and implementing effective business plans.

- Performance Evaluation: By tracking key financial metrics, bookkeeping can help businesses evaluate their performance and identify areas for improvement.

Bookkeeping Methods

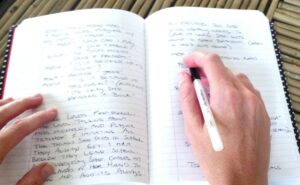

- Manual Bookkeeping: Traditional method using pen and paper to record transactions in journals and ledgers.

- Computerized Bookkeeping: Using accounting software to automate the recording and analysis of financial data.

Summary

Bookkeeping is a vital aspect of financial management, providing essential information for decision-making, compliance, and overall business success. By maintaining accurate and up-to-date bookkeeping records, businesses can improve their financial health, enhance their credibility, and achieve their long-term goals.

Questions

- What is bookkeeping?

- Why is bookkeeping important for businesses and individuals?

- What are the key components of a bookkeeping system?

We have come to the end of today’s class. I hope you enjoyed the class!

In the next class, we shall be talking about Source Documents

In case you require further assistance or have any questions, feel free to ask in the comment section below, and trust us to respond as soon as possible. Well done so far and See you in the next class!