Back to: Store Management SS 2

Welcome to today’s class!!

We are thrilled to have you in our class!!

In today’s Store Management class, we will be focusing on Revision

Revision

As students, if there is a moment that you can look forward to to refresh your memory before writing your exams, is the Revision period. And because Revision is a very important step in fostering adequate preparations for examinations, it is important to enjoy it.

Let’s take a look at some of the topics we’ve covered so far.

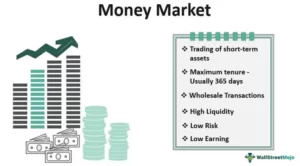

Money Market

Money market basically refers to a section of the financial market where financial instruments with high liquidity and short-term maturities are traded. Money market has become a component of the financial market for buying and selling of securities of short-term maturities of one year or less, such as treasury bills and commercial papers.

Another thing about Money Market is that, over-the-counter trading is done in the money market and it is a wholesale process. It is used by the participants as a way of borrowing and lending for the short term.

Money market consists of negotiable instruments such as treasury bills, commercial papers. and certificates of deposit. It is used by many participants, including companies, to raise funds by selling commercial papers in the market. Money market is considered a safe place to invest due to the high liquidity of securities.

An example of institutions in the Money Market is the Central Bank of Nigeria and the Nigeria Deposit Insurance Corporation.

Let’s take a brief look at the CBN and the NDIC

The Central Bank of Nigeria is the central bank and highest monetary authority of Nigeria established by the CBN Act of 1958 and commenced operations on 1 July 1959.

The major regulatory objectives of the bank as stated in the CBN Act are to: maintain the external reserves of the country, promote monetary stability and a sound financial environment, and act as a banker of last resort and financial adviser to the federal government. The central bank’s role as lender of last resort and adviser to the federal government has sometimes pushed it into murky regulatory waters. After the end of imperial rule, the desire of the government to become proactive in the development of the economy became visible, especially after the end of the Nigerian civil war, the bank followed the government’s desire and took a determined effort to supplement any show shortfalls, credit allocations to the real sector. The bank became involved in lending directly to consumers, contravening its original intention to work through commercial banks in activities involving consumer lending.

The NDIC-Nigeria Deposit Insurance Corporation, is an independent agency of the Federal Government of Nigeria. The purpose of the deposit insurance system is to protect depositors and guarantee the settlement of insured funds when a deposit-taking financial institution can no longer repay their deposits, thereby helping to maintain financial system stability.

Its mission is to protect depositors and contribute to the stability of the financial system through effective supervision of insured institutions, provision of financial/technical assistance to eligible insured institutions, prompt payment of guaranteed sums and orderly resolution of failed insured financial institutions.

In summary, the money market is an organized exchange market where participants can lend and borrow short-term, high-quality debt securities with average maturities of one year or less.

Similarities Between Money And Capital Market

In the money market, we can find instruments traded in the money market which include Treasury bills, certificates of deposit, commercial paper, federal funds, bills of exchange, and short-term mortgage-backed securities and asset-backed securities.

Now, let’s consider the differences between Capital Market and Money Market

- Both are important components of the international finance market

- Both markets permit investors to purchase debt securities

- Businesses and governments depend on both the markets for raising money for operations

Borrowing and lending money in a money market occurs simply and easily with a payback guarantee. The capital market does not provide borrowing or lending money. The money market borrowing and lending can be taken or given over billions of rupees for a short time of period. The capital market borrowing or lending money is done through buying or selling bonds and stocks for a long term of time over billions of rupees.

The capital fund is given by the supplier of capital in terms of buying financial bonds and stocks from the one who needs the money. Both the capital and money market exchange a large number of capital funds. Lenders and borrowers are lending and borrowing the short-term capital funds with short-term security. The capital market allows borrowing and lending a large amount of money for a long term of time with long-term security. The capital market gives the opportunity for borrowing and lending a large amount of money for a long term of time with a long-term security.

Both the money and capital markets facilitate participants to buy debt securities. Debt securities are financial products where the borrower promises the lender to pay back the debt amount. Other types of money markets and securities are also exchanged in the capital market. A high amount of rupees is exchanged daily in both types of markets. The expanded activities of the government or any business activity is paid for through lending money from both types of markets. Even the capital needed for operations of government or business is sometimes borrowed from both types of markets depending on the time. Both the markets do not exchange stocks and bonds offline or hand to hand. These usually exchange money through some particular online platforms.

Capital markets are long-term investments and provide purchase debt securities. The governments and businesses are dependent on both markets for getting the needed money for operations.

In summary, Both the capital and money market are very important aspects of the international market. Though there are many differences between both types of markets, both markets provide the facilities to get or use capital funds based on participants’ interests. Lending or borrowing money from the capital market will give a long period to pay back the money. The money market does not provide a long period but provides as large capital as the capital market. Stocks and bonds can be bought in both types of the market with debt security for a particular period.

Securities And Exchange Commission

The Securities and Exchange Commission (SEC) is the main regulatory institution of the Nigerian capital market. It is supervised by the Federal Ministry of Finance. The Nigerian Stock Exchange (NSE) is privately owned and self-regulating, but the SEC maintains surveillance over it with the mandate of ensuring orderly and equitable dealings in securities, and protecting the market against insider trading abuses.

Let’s take a journey into the history and significance of the Securities and Exchange Commission.

The origin of the Securities and Exchange Commission dates back to 1962, when an ad hoc consultative and advisory body, known as the Capital Issues Committee, was established under the aegis of the Central Bank of Nigeria (CBN). Its mandate was to examine applications from companies seeking to raise capital from the capital market and recommend the timing of such issues to prevent issues clustering which could overstretch the market’s capacity. The Committee operated within the Central Bank of Nigeria unofficially as a capital market consultative and advisory body with no regulatory framework.

An increase in the level of economic activities, coupled with the promulgation of the Nigerian Enterprises Promotion Decree in 1972, necessitated the establishment of a body backed by law to regulate capital market activities hence the creation of the Capital Issues Commission to take over the activities of the Capital Issues Committee. The Capital Issues Commission was established with the promulgation of the Capital Issues Commission Decree in March 1973.

The new body had a board of nine (9) members, including a representative of the Central Bank of Nigeria who served as Chairman, while the other eight (8) members were drawn from some Federal Ministries, the industrial and financial sectors of the economy.

In order to cope with emergent challenges, the powers of the Capital Issues Commission had to be further enhanced. A Financial System Review Committee was set up by the federal government to review capital market activities and proffer ways of developing the market.

The recommendations of the Financial System Review Committee in 1976, led to the establishment of the Securities and Exchange Commission following the promulgation of the Securities and Exchange Commission Decree No. 71 of 1979 to supersede the Capital Issues Commission in 1979.

The Commission had more powers to regulate and develop the Nigerian capital market, in addition to determining the prices of issues and setting the basis for allotment of securities. Unlike its two predecessors, the Commission at this stage was excised from the CBN, although it continued to receive funding from the apex bank.

It also had an enlarged 12-member board with a CBN representative as Chairman. Other members were drawn from the Ministries of Finance, Trade and Industries, the Nigerian Stock Exchange and the Nigerian Enterprises Promotion Board; other members were nominated on the basis of individual merit.

The Commission took off effectively on January 1, 1980 with 51 staff out of which seven (7) were seconded (for a period of three years) from the Central Bank of Nigeria (CBN) while a few senior and support service staff were recruited.

Nine (9) years after the establishment of the Securities and Exchange Commission, the enabling law, Decree No. 7 of 1979, was re-enacted as SEC Decree No. 29 of 1988 with additional provisions to address observed lapses in the previous arrangement and to enable the Commission to pursue its functions more effectively.

To further enhance the Commission’s pursuit of its objective of investor protection, a review of the capital market was carried out in 1996 by a seven – man panel headed by Chief Dennis Odife. Based on the panel’s recommendations, a new Act known as “The Investment and Securities Act No. 45 of 1999” was promulgated on May 26, 1999. The Act repealed the SEC Act of 1998. The new Act was expected to promote a more efficient and virile capital market, pivotal to meeting the nation’s economic and developmental aspirations.

The Investment and Securities Act (ISA) was further reviewed, amended and subsequently passed into law in 2007. The SEC currently derives its powers from the ISA 29 of 2007.

The Securities and Exchange Commission (SEC) joined the International Organisation of Securities Commissions (IOSCO) in June 1985. The IOSCO is a body of Securities Commissions with the goal of cooperating in developing, implementing and promoting adherence to internationally recognised and consistent standards of securities market regulation.

The Nigerian SEC qualified as an Appendix ‘A’ Signatory to the IOSCO MMOU in 2006 and has continuously been benchmarking its market rules and regulations against those of IOSCO, the global international standards setter.

In summary, the Securities And Exchange Commission was established to examine applications from companies seeking to raise capital from the capital market and recommend the timing of such issues to prevent issues clustering which could overstretch the market’s capacity.

Evaluation

Explain the role of Securities And Exchange Commission.

Reading Assignment

- Explain who a Shareholder is.

- What is another name for shares?

Weekend Assignment

Explain the following:

- Money Market

- Capital Market

- Differences Between Money Market and Capital Market

We hope you enjoyed today’s class. Go ace your exam!

Let us know your thoughts and questions in the comment section, and we will attend to them as fast as we can.