Back to: Store Management SS 2

Welcome to today’s class!!

We are thrilled to have you in our class!!

In today’s Store Management class, we will be learning about Introduction To Imprest System

Introduction To Imprest System

As Business people look for a simple way to keep track of their petty cash, an Imprest account has always proven to be ideal. In short, the Imprest petty cash procedure is a rudimentary method for tracking petty cash disbursements.

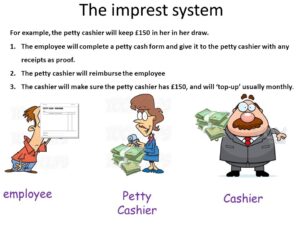

The Imprest system is an accounting system that’s used to track how a business is spending cash. In most cases, Imprest systems are used to account for petty cash (a small amount of money used for expenditure on smaller items, that is, office supplies, catered lunch, cards for customers, and so on). The key feature of the Imprest system is the fact that all expenditures must be documented. This gives a business a greater degree of control over cash disbursements made by their company.

One of the main benefits of the Imprest system is the fact that it helps to deter unauthorized spending, as the money in the account is earmarked for a particular use. Because Imprest accounts pay out roughly the same amount of cash on a regular basis before they are automatically replenished, it’s much easier to flag discrepancies and detect employee fraud. Put simply, you’ll gain much more visibility into your petty cash balances as well as how that cash is being used.

The essential features of an imprest system are noted in the following points:

- A fixed amount of cash is allocated to a petty cash fund, which is stated in a separate account in the general ledger.

- All cash distributions from the petty cash fund are documented with receipts.

- Petty cash disbursement receipts are used as the basis for periodic replenishments of the petty cash fund.

- Variances between expected and actual fund balances are regularly reviewed and investigated.

In conclusion, expenses are recognized when new cash replenishments are made to the petty cash fund from the company checking account. When cash is paid from the checking account, the entry is a debit to the various expenses for which receipts are being supplied by the petty cash custodian, and a credit to the cash account.

Evaluation

What is an Imprest Account?

Reading Assignment

Explain three functions of an Imprest System

Weekend Assignment

Explain how an Imprest Account is different from a Cash Account.

We hope you enjoyed today’s class. In our next class, we will be talking about Advantages and Disadvantages of Imprest System

Let us know your thoughts and questions in the comment section, and we will attend to them as fast as we can.