Back to: COMMERCE SS1

Welcome to class!

In today’s class, we will be talking about the cheque system. Enjoy the class!

The Cheque System

CONTENTS

- Parties to a cheque

- Advantages of payment by cheque

- Types of cheques

- Dishonoured cheques

Cheque

A cheque is a bill of exchange drawn on a banker payable on demand

Parties to a cheque

There are three parties involved with a cheque namely:

- The Drawer i.e. the person who issues the cheque

- The Drawee i.e. the bank is instructed to pay the money

- The Payee i.e. the person named on the cheque to receive the money from the bank.

The drawee of the cheque also becomes the payee when the amount payable on the cheque is to be received by himself.

Advantages of payment by cheque

- Convenience: Cheque may be made out for any sum of money and requires no change. They are therefore a convenient means of making payments.

- Security: It is safer to carry cheque than cash for security reasons.

- Easy to trace: cheques are numbered and may, therefore, be easily traced when the need arises.

- It provides a record of payments and receipts i.e. it is needless for the payee to send a receipt for such payment.

- Portability: cheques are easy to carry about and therefore make carrying large sums of money unnecessary.

- Reduced risk of loss: a cheque is an absolutely safe means of payment especially when crossed as the risk of loss is eliminated

- Payment may be stopped by the drawer. E.g. so as to prevent fraud.

- The use of cheques reduces the demand for banknotes and coins.

- The use of cheques saves the time and energy involved in counting cash.

Types of cheques

- Bearer Cheques: These are worded “Pay…… or Bearer” and would be paid by the bank to whoever is presenting the cheque for payment whether the name on the cheque is his or not. Such cheques are not as safe as order cheques. A bearer cheque does not require endorsement when negotiating it (i.e. transferring it to another person).

- Order Cheque: Such cheques are worded “pay…………… or Order” and would only be paid to the person or firm whose name appears on it, or to his order – i.e. any other person to whom the payee endorses the cheque to.

- Open Cheque: These are cheques that are not crossed and can, therefore, be presented and cashed over the counter of the bank on which it is drawn. An open cheque is not safe as crossed cheques as there is a risk that it can be paid to a wrong person.

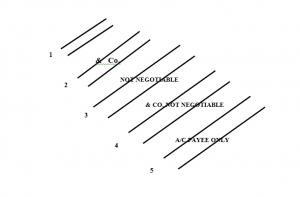

- Crossed Cheques: These are cheques that have two parallel lines drawn across the face with or without the words “& Co.” “A/C payee only”, “Not Negotiable” etc. crossed cheques cannot be cashed over the counter of the bank but must be paid into a bank current account. They are therefore safer than open cheques.

A crossed cheque can be made open by the drawer writing the words “Pay Cash” on it and adding his signature immediately after the words “Pay Cash”

Types of crossing

There are two types of crossing on cheques namely general crossing and special crossing.

- General Crossing: This is effected by drawing two parallel lines across the face of a cheque with or without the word “& Co.” “Not Negotiable”, “A/C Payee Only”. etc. as found below.

Effects of general crossing

General crossing makes such a cheque payable into a bank account for collection i.e. it cannot be cashed over the counter. It, therefore, affords protection against fraud.

Crossing a cheque does not necessarily prevent it from being stolen. However, it makes it easy for the thief to be traced since he has to use a bank account to cash such a cheque.

General evaluation

- Explain five features of itinerant trading

- State five features of a supermarket

- List five disadvantages of pre-packaging

In our next class, we will be talking more about Cheque System. We hope you enjoyed the class.

Should you have any further question, feel free to ask in the comment section below and trust us to respond as soon as possible.

Where can I get the next class note from