Back to: COMMERCE SS1

Welcome to class!

In today’s class, we will be talking more about the cheque system. Enjoy the class!

The Cheque System II

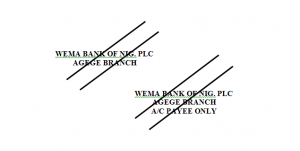

- Special Crossing: This is effected by writing the name of a bank across the face of the cheque with or without the parallel lines and the word “& Co.” “Not Negotiable” “A/C Payee Only” etc as found below.

Effects of special crossing

Special crossing limits payments of such a cheque into the bank whose name is written on the face of that cheque. This ensures greater and stricter protection against fraud.

Definition of terms associated with cheque

- Post-dated Cheque: This is a cheque that is presented for payment before the date shown on it. The bank will not pay until the specified date is due.

- Stale cheque: This is a cheque that is presented for payment more than six months after the specified date. The bank will not pay this cheque.

- Endorsement: To endorse a cheque means that the payee has to append his signature at the back of the cheque.

- Certified Cheque: This is a cheque on which a bank has signified that the drawer has enough fund to pay and that, in any case, the cheque cannot be dishonoured.

- Dishonoured cheque: (i.e. “Bounced” Cheque). A dishonoured cheque is one which a banker on whom it is drawn has for some reasons refused to pay on a presentation for payment by the payee. Before returning a dishonoured cheque to his customer the banker usually writes on it the reason for dishonouring e.g “R/D” (i.e. Refer to Drawer) “Account closed”, DAR i.e. (Drawer Attention Required), Orders Not to Pay” etc.

Reasons for dishonouring a cheque

- Insufficient fund

- When payment is stopped by the drawer

- Irregular signature (i.e. Drawer Signature Irregular)

- The difference in figure and word

- Cheque mutilated

- Alteration on cheque not endorsed by the drawer.

- Stale cheque

- Post-dated cheque

- Death of drawer

- The insanity of the drawer

- The bankruptcy of the drawer

- Account closed

- The account is frozen on court order/Garnishee order

- No Account i.e. Account does not exist etc.

Review questions

- Explain six reasons why a trader would prefer the use of cheque to cash for large payments.

- Explain each of the following (a) Order cheque (b) Certified cheque (c) Crossed cheque

- What is meant by the following words written on a cheque (a) Not Negotiable (b) Accounts Payee only.

- State two safeguards which could prevent the fraudulent use of a cheque.

General evaluation

- Explain five features of itinerant trading

- State five features of a supermarket

- List five disadvantages of pre-packaging

- State six factors which a bank manager considers in granting loans to customers

- In which seven ways does branding affect the consumer

Theory

- List three parties to a cheque

- State five reasons why a bank will dishonour its customer’s cheque.

Reading assignment

- Essential Commerce for SSS by O. A. Longe Page 86 – 92

- Comprehensive Commerce for SSS by J. U Anyaele Page 187 – 195

In our next class, we will be talking about Negotiable Instruments – Bills of Exchange and Others. We hope you enjoyed the class.

Should you have any further question, feel free to ask in the comment section below and trust us to respond as soon as possible.

Wow new