Back to: FINANCIAL ACCOUNTING SS3

Welcome to class!

In today’s class, we will be talking about the final accounts of a partnership. Enjoy the class!

Final Accounts of a Partnership

CONTENT

- Profit & Loss Appropriation Account of a partnership

- Balance Sheet of a Partnership

Profit and loss appropriation account of a partnership

This, as the name implies, is the account where either the profit or loss of the partnership business is shared between or among the partners as stipulated in the partnership agreement. The profit and loss appropriation account mark the beginning of the difference between the final accounts of a sole trader and that of a partnership. This is because while the sole trader does not share his profit with any-body, the profit of the partnership must be shared by the partners.

Some terminologies in profit & loss appropriation account of a partnership

- Drawings: Partners can withdraw at regular or irregular intervals, from the sum they are entitled to at the end of the year. The total drawings are credited to the cash book and debited to current accounts.

- Interest on drawings: This is the interest charged on drawings made by the partners. To discourage or reduce the amount of cash withdrawn, a fixed sum or % will be charged as interest. The interest in the drawing will increase net profit and discourage drawings. It can be calculated on monthly basis. Interest is calculated from the date the amount is withdrawn to the end of the financial year.

- Partners’ Salary: The agreement made provision for salary to be paid to active partners. It is desirable to compensate the active partner for the day-to-day running of the business.

- Interest on Capitals: Partners contribute different amounts as capital. To compensate the partners for capital contributed, interest on capital is allowed.

The balance sheet of a partnership business

There is no significant difference between the balance sheet of a sole trader and that of a partnership. The only difference is on the display of capital accounts and current accounts of partners which will be illustrated in the formats below:-

Format 1

Trading, profit and loss of A and B Enterprises for the year ended 31st December 2006

N N N N

Opening stock x Sales x

Add Purchases x less Returns inwards x x

Add Carriage inwards x

X

Less Returns Outwards x x

Cost of goods available for sale x

Less Closing stock x

Cost of goods sold x

Gross profit c/d x

x x

Expenses

Wages and salaries x Gross profit b/d x

Depreciation of assets x Discounts received x

Sundry expenses x

Bad debts x

Interest on loan x

Discount allowed x

Carriage outwards x

Net profit c/d x

X X

Format 2

Profit and Loss Appropriation account A and B

N N N N

Partners salary x Net profit b/d x

Interest on capital: A x Interest on drawings:

B x x A x

Share of profit B x x

A (½ x) x

B (½ x) x x __

X x

Format 3

The balance sheet of A and B Enterprises as at 31st Dec 2006

N N N N

Capital accounts Fixed assets

A x Furniture & fitting x

B x x Less depreciation x x

Current accounts Motor van x

A x

B x x Current assets

Current liabilities Stock x

Loan x Debtor x

Creditors x Bank x

Expenses owing x x Cash in hand x x

X x

Example

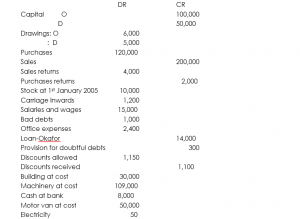

O and D are in partnership sharing profit and loss in the ratio 3:2. The following is the Trial Balance as at 31 December 2005

Additional Information

- Stock at close N 15,000

- Salaries and wages accrued N 1,000

iii. Electricity prepaid N 20

- Interest on capital at 10%

- Interest on drawings at 5%

- Depreciate motor can 10% on the cost

vii. Partnership salary: O N 2,000

viii. Provision for doubtful debts to be reduced to N 200

ix. O withdrew N 7,000 goods for own use

You are required to:

- Prepare the Trading, Profit and loss account for the year ended 31 Dec 2006.

- Partners’ capital account

- Balance sheet as at 31st Dec. 2006

Solution

Trading, Profit and Loss of O and D for the year ended 31st December 2006.

N N N N

Opening stock 10,000 Sales 200,000

Add purchases 120,000 Less Returns inwards 4,000

Add carriage inwards 1,200

121,200

Less Ret outwards 2,000

119,200

Less Goods withdrawn 7,000 112,200

Cost of Goods available for sale122,200

Less closing stock 15,000

Cost of goods sold 107,200

Gross profit c/d 88,800

196,000 196,000

Expenses Gross profit bld 88,800

Salaries and wages (wk 1) 16,000 Discount received 1,100

A decrease in provision for

Bad debts 1,000 bad debts (wk 3) 100

Office expenses 2,400

Discount allowed 1,150

Electricity (wk 4) 30

Carriage outwards 500

Depreciation-motor can (wk 2) 5,000

Net profit c/d 63,920

90,000 90,000

Appropriation account

N N N N

Net profit 63,920

Partner salary – O 2,000 Interest on drawings:

Interest on capital: O 300

O 10,000 D 250 550

D 5,000 15,000

Share of profit:

D 18,988

O 28,482 47,470

64,470 64,470

Partnership Columnar current account

O D O D

N N N N

Drawings 6,000 5,000 Balance b/f 1,500 3,000

Int on drawings 300 250 Share of profit 28.482 18,988

Goods withdrawn 7,000 – Interest on capital 10,000 5,000

Balance c/d 28,692 21,738 Salary 2,000 -____

41,982 26,988 41,982 26,988

Bal b/d 28,692 21,738

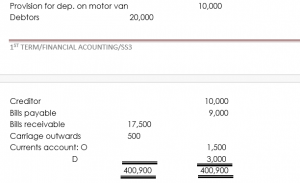

Balance sheet as at 31st December 2006

N N N N N

Capital: O 100,000

D 50,000 150,000 Fixed assets

Building 30,000 30,000

Current account: Machinery 109,100 109,100

O 28,682 Motor van 50,000 139,100

D 21,738 50,420 Less Depr. 15,000 35,000

174,100

Current liabilities Current assets

Loan Okafor 14,000 Stock 15,000

Creditors 10,000 Bank 8,000

Bills payable 9,000 Debtors 20,000

Wages owing 1,000 34,000 Less provision 200 19,800

Bills receivable 17,500

Electricity prepaid 20 60,320

234,420 234,420

Workings

- Salaries and wages

Amount paid 15,000

+ Owing 1,000

Profit and loss 16,000

- Depreciation: Motor van

10% x 50,000

Profit and loss 5,000

Accumulated depreciation = 10,000 + 5,000 = 15,000

- Provision for bad debts 4. Electricity 50

Old provision 300 Less Prepaid 20

Less New provision 200 Profit and loss 30

Profit and loss 100

- Interest on capital: 6. Share of profit

O : 10% x 100,000 O = 3/5 x 47,470 = 28,482

= 10,000 D = 2/5 x 47,470 = 18,988

D : 10% x 50,000

= 5,000

- Interest on drawings:

O : 5% x 6,000

= 300

D : 5% x 5,000

= 250

Evaluation

- Explain (a) appropriation account (b) Balance sheet

- What is interest on capital?

General evaluation

- List five items that are debited in the sales ledger control account

- List five items that are credited in the purchases ledger control account

- List five subsidiary books from which the sales ledger control is compiled

- State five contents of the Appropriation Account of a partnership

- List five characteristics of depreciable assets

Reading assignment

Essential Financial Accounting by O. A. Longe, Page 249 – 258

Weekend assignment

Use the following information to answer questions 1 – 5. A, B, and C are in partnership sharing profits and losses in the ratio 3:2:1 respectively. Their capital accounts are A: N60,000 B. N40,000 and C: N 30,000. Interest on capital is agreed at 5% p.a. interest on drawings is also agreed at 5% p.a. Their drawings for the year are A: N 6,000 B: N 4,000 and C: N 3,000. The profit for the year before an appropriation is N 30,000 C is entitled to a partnership salary of N2,000 p.a

- What is the total of A and B’s interest on capital? (a) N4,000 (b) N3,000 (c) N5,000 (d) N10,000

- What is the total of B and C’s interest on the drawing? (a) N350 (b) N250, (c) N450 (d) N400

- Total interest on the partners’ capital for the year is (a) N7,000 (b) N6,000 (c) N6,500 (d) N5,500

- Total credit entries in the appropriation account is (a) N550 (b) N30,000 (c) N35,500 (d) N30,550

- Which of the following is not debited to the profit and loss appropriation account? (a) C’s salary (b) Partner’s interest on capital (c) Share of profit (d) Share of loss

Theory

- Write short notes on (a) Interest on capital (b) Interest on drawing

- Give the double entries for the following in the final account of a partnership. (i) Interest on drawings N500 (ii) Partnership salary N3,000 (iii) Interest on capital N5,000 (iv) Share of profit N10,000

In our next class, we will be talking about the Admission of Partners. We hope you enjoyed the class.

Should you have any further question, feel free to ask in the comment section below and trust us to respond as soon as possible.