Back to: FINANCIAL ACCOUNTING SS3

Welcome to class!

In today’s class, we will be talking about partnership accounts. Enjoy the class!

Partnership Accounts

CONTENT

- Partnership Agreement

- Capital and Current Account

Introduction

A partnership can be defined as the relationship which exists between two or more persons who are carrying on business in common with a view of making a profit. The rules governing the conduct of a partnership business is contained in the document known as the Deed of Partnership or Articles of Partnership or Partnership Agreement.

Contents of the deed of partnership

The partnership Deed contains among others, the following.

- Name of the partnership

- Names of the partners

- Capital contribution

- Nature of the partnership business

- Profit and loss sharing ratio

- Interest on capital contribution

- Interest chargeable on drawings

- Duration of the partnership

- Rules regarding admission or retirement of a partner

- Rules on the dissolution of the partnership

When there is no agreement

Where there is no specific arrangement concerning the partnership agreement, section 24 of the Partnership Act 1890 laid down the rules that should be applied as follows:-

- No interest to be paid on capital contributed by each partner

- No partner should receive a salary or remuneration.

- Profits and losses are to be shared equally.

- No interest is to be charged on drawings

- 5% interest should be allowed on any loans made by any partner above the agreed capital contribution.

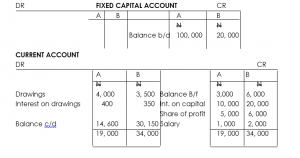

Fixed capital account:

The capital accounts of partners are usually regarded as fixed to provide permanent evidence of the initial amount with which the partnership is commenced. Where capital is regarded as fixed, a current account must be opened for each of the partners.

Partners current account:

The current account of each partner is prepared to show what such a partner is entitled to withdraw from the business at any point in time. It is credited with salary, commission, the share of profits, interest on capital, and debited with drawings, interest on drawings, etc.

Example 1:

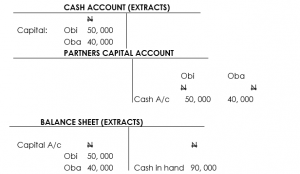

Obi and Oba are partners in a firm of chartered accountants with initial capital contributions of N50,000 and N40,000 respectively which are to be kept fixed in the partnership books. You are required to show the cash account, partners’ capital accounts and balance sheet extracts.

Solution

A fixed capital account with a current account

As illustrated above where the capital account will remain fixed according to the agreement, the current account must be opened for each partner. It is debited with drawings, interest on drawings and credited with interest on capital, the share of profit and partner’s salary.

However, there are instances where the partners under the partnership deed, maintain floating or fluctuating capital account.

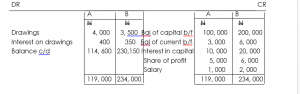

Floating capital without a current account

This is simply a combination or mixture of the capital and current accounts of each partner in a capital account hence such a capital account is referred to as “floating” or “fluctuating” because the balance can increase or decrease at any time depending on how much is paid in and how much is withdrawn.

Fluctuating capital account

Evaluation

- Define Partnership

- List seven items that should be contained in a partnership deed.

General evaluation

- Differentiate between accounting concepts and convention

- Explain four classifications of the cost found in manufacturing accounts

- State five reasons why a trial balance may not balance

- State five limitations of the Receipts and Payments Account

- Explain five events that may lead to the dissolution of a partnership

Reading assignment

Essential Financial Accounting by O.A. Longe Page 249-251.

Weekend assignment

- Where there is no partnership agreement the Partnership Act 1890 section _______ should be applied (a) 20 (b) 25 (c) 24 (d) 34

- Which of the following is not true where there is no laid down an agreement for the partnership? (a) Profits and losses to be shared equally (b) No interest in drawings (c) No interest in capital (d) Members of the public can invest in the shares of the business.

- Which of the following increases the profit of a partnership? (a) Drawings (b) Interest on capital (c) Interest on drawings (d) Partnership salary

- Which of the following statements is NOT true? When (a) we keep fixed capital accounts for partners we open their current accounts (b) losses are made they are to be shared by the partners (c) we keep floating capital account no current account is kept (d) A partnership can exist forever.

- Which of the following can represent capital contributed by a partner to a partnership? (a) Cash only (b) Cheques (c) Cash and cheques (d) Cash, cheque and other assets.

Theory

- List the rules approved by the Partnership Act 1890 to be applied where there is no partnership agreement.

- Prepare the capital and current accounts of the following partners:-

. N

Capital accounts Obi 50, 000 cr.

Oba 20, 000 cr.

Interest in capital 5% p.a.

Salaries Obi 5, 000

Oba 6, 000

Interest on drawings 5%

Drawings Obi 2, 000

Oba 1, 500

Current accounts balance b/f

Obi 3, 000 cr.

Oba 500 dr.

In our next class, we will be talking about Final Accounts of a Partnership. We hope you enjoyed the class.

Should you have any further question, feel free to ask in the comment section below and trust us to respond as soon as possible.

SIR. AN AMOUNT WAS NOT GIVEN ON THE DRAWINGS, HOW DO I CALCULATE FOR THE INTEREST ON DRAWING WITH THE 5%. THANKS

Thanks so much sir.

It’s nice but we need to do more of practicals and explanations.

I really appreciate you if doing this practicing and we need more of it’s

i did really enjoyed the class