Back to: ECONOMICS SS2

Welcome to class!

In today’s class, we will be talking about the cost concept. Enjoy the class!

Cost Concept

The meaning of cost of production

Cost of production refers to the total cost incurred by a manufacturer in the cause of producing a good or providing a service. These expenses (costs of production) include but not limited to the following- the cost of labour, cost of raw materials, cost of consumable manufacturing supplies and general overhead. Taxes levied by the government or royalties owed by natural resources extracting companies are also part of the cost of production.

From the above, it is clear that the cost of production (which can also be referred to as the production cost) include all the expenditures relating to the production of goods/services. Therefore, before a cost can qualify to be classified under the cost of production category, it must be directly tied to the generation of revenue for the company. Please note also that manufacturers deal with the cost of the product of both the materials required to create an item as well as the labour needed to turn the raw materials into finished products.

The meaning of cost to an accountant and an economist

In Accounting and Business as a whole, the word “cost” is viewed as the monetary value spent by a company to produce something. An Accountant is therefore interested in cost because it tells him or her the total amount of money that a company spends on the creation or production of goods or services. Taking note of the cost of production helps an Accountant or to among other things be able to figure out the cost of production per unit and as such set the appropriate sales price for the products. To determine the cost f production per unit, Accountants divide the cost of production by the number of units produced.

Different types of economic costs

- Fixed Costs (FC): These type of costs does not vary with changing output. Fixed costs might include the cost of building a factory, insurance and legal bills. Even if your output changes or you don’t produce anything, your fixed costs stay the same. In the above example, fixed costs are always N1,000.

- Variable Costs (VC): These are costs which depend on the output produced. For example, if you produce more cars, you have to use more raw materials such as metal. This is a variable cost.

- Semi-Variable Cost: An example of a semi-variable cost is labour. If you produce more cars, you need to employ more workers to engage in the entire production and marketing activities. This is therefore a variable cost. However, even if you didn’t produce any cars, you may still need some workers to look after the empty factory.

- Total Costs (TC): – Fixed + Variable Costs

- Marginal Costs: Marginal cost is the cost of producing an extra unit. If the total cost of 3 units is 1550, and the total cost of 4 units is 1900. The marginal cost of the 4th unit is 350.

- Opportunity cost: Opportunity cost is the next best alternative foregone. If you invest N1 million in developing a cure for pancreatic cancer, the opportunity cost is that you can’t use that money to invest in developing a cure for skin cancer.

- Economic Cost: Economic cost includes both the actual direct costs (accounting costs) plus the opportunity cost. For example, if you take time off work to a training scheme. You may lose a weeks pay N350, plus also have to pay the direct cost of N200. Thus the total economic cost = N550.

- Accounting Costs: this is the monetary outlay for producing a certain good. Accounting costs will include your variable and fixed costs you have to pay.

- Avoidable Costs: Costs that can be avoided. If you stop producing cars, you don’t have to pay for extra raw materials and electricity. Sometimes known as an escapable cost.

Long and short term costs

Long Term Costs are accumulated when firms decide to change their production levels over time in response to expected economic profits or losses. This will therefore mean that there will not be fixed factors of production. On the other hand, Short Term Costs are accumulated in real-time throughout the production process.

Differences between long and short term costs

The main difference between long-run and short-run costs is that there are no fixed factors in the long run; there are both fixed and variable factors in the short run. In the long run, the general price level, contractual wages, and expectations adjust fully to the state of the economy. In the short run, these variables do not always adjust due to the condensed time period. To be successful, a firm must set realistic long-run cost expectations. How the short-run costs are handled determines whether the firm will meet its future production and financial goals.

Cost curve

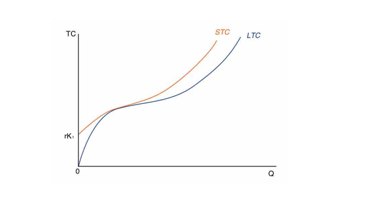

This graph shows the relationship between long-run and short-run costs.

In our next class, we will be talking about Revenue Concept. We hope you enjoyed the class.

Should you have any further question, feel free to ask in the comment section below and trust us to respond as soon as possible.