Back to: ECONOMICS SS2

Welcome to class!

In today’s class, we will be talking about the theory of income determination. Enjoy the class!

Theory of Income Determination

CONTENT

- Circular Flow of Income

- Concept of Saving

- Concept of Investment

- Concept of Consumption

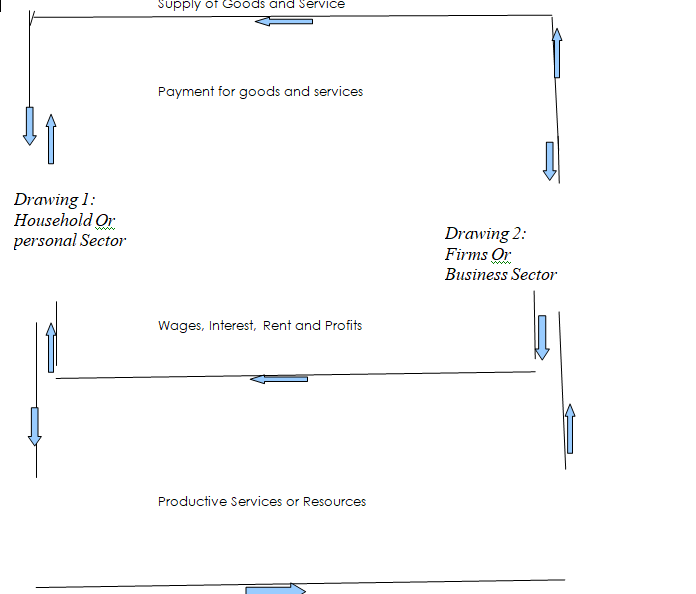

CIRCULAR FLOW OF INCOME

Circular flow of income shows the independence or relationship between households and business enterprise

Commodity and money flow between households and firms. It shows the flow of payments from the business sector to households in exchange for labour and other products services and the return flow of payments from households to business sector in exchange for goods and services.

The household or the personal sector offers its labour services to the business sector or firms in the production of goods and services. The household is rewarded in form of wages, interest and rent which it spends on the consumption of goods and services produced in the economy.

FACTORS THAT BRINGS ABOUT CHANGES IN THE CIRCULAR FLOW OF INCOME

- Withdrawal: This part of all the income that is not allowed to pass through the normal channel of a circular flow of income.

- Injection: This forms an increase in the income of households, producers outside their normal processes of selling productive resources and manufactured goods.

- Savings: These are part of income which are not consumed immediately and they reduce households and producers expenditures.

- Investment: This reduces and creates additional income either immediately or in future.

- Gifts and grants: They may come from governments to households and firms and help to increase their incomes

- Taxes: They reduce the expenditures of households and firms on goods and factor services.

- Imports: They involve the expenditure on foreign-made goods and services and constitute withdrawals from the circular flow of income.

- Export: Provide money from other countries and act as an injection into the domestic circular flow of income.

EVALUATION

- Explain the following terms:

(i) Withdrawal (ii). Savings (iii). Injection. (Iv). Import and Export

CONCEPTS OF SAVINGS, INVESTMENT AND CONSUMPTION

SAVINGS

Savings are made up of disposable income which is not spent on consumer goods and services. Saving involves forgoing some present consumption.

Individuals save for the following reasons

- To raise capital

- For unforeseen contingencies

- For speculation

- To acquire assets

- For future purposes

- To raise social status

Factors that affect savings

- The size of income

- The rate of interest

- Cultural attitude

- Government policies

- Availability of financial institutions.

EVALUATION

- Give four reasons why individual saves.

- List and discuss three factors affecting savings.

INVESTMENTS

Investment may be defined as expenditure on physical assets which are not for immediate consumption but the production of consumer and capital goods and services.

Types of Investment

- Individual investment: This may be on building, motor vehicles and other assets the individual hopes may increase his income and standard of living.

- Investment by firms: This can be on buildings machines, furniture, raw materials, semi-finished and finished goods.

- Government investment in social capital: These are in the areas of roads, electricity, pipe-borne water, hospitals schools. To improve the living condition of the citizen.

- Government investment in public corporations: To render essential services create more employment opportunities among others are sure of the reasons why government invest.

Factors that determine investment

- The amount of income earned.

- Savings

- Profit

- The amount paid as tax

- The rate of interest

- Expectation

- Business atmosphere

- Political factor

CONSUMPTION

Consumption is the sum of current expenditure on goods and services by individuals, firms and government. It is also mean part of income not saved or invested. The level of consumption of an individual depends largely on his level of current income.

Factors that determine the level of consumption

- The level of income

- Savings

- The expectation of price changes

- The rate of taxes paid

- The influence of other households

- Assets owned

- The rate of interest received

- Business profit

EVALUATION

- Give five factors that determine the level of consumptions.

- What is Investments?

The Relationship Between Income, Consumption, Savings And Investment

Income, consumption and savings are related. The amount of income earned (household) determines to a large extent the level of consumption of an individual as well as the amount which can be saved. This is represented by the formula. Y = C+S, where Y = Income, C = Consumption expenditure and S = Savings

Also, income, consumption and investment are related. The amount of income earned (business sector) determines to a large extent the level of spending on the running overhead cost (consumption) as well as the amount spent on further investment. This is represented by the formula: Y = C + I,where Y = Income, C = Consumption expenditure, I = Investment Expenditures

In forming an equation with household income and the business sector’s income, we have:

C + S = C + I

S = I

Consumption influences the level of national income. If people consume more, it encourages further production. The economy is at equilibrium when aggregate saving equals aggregate investment and full employment is achieved at this level. We save to accumulate capital for investment and many other personal reasons. There will be no investment without saving. Investment, in turn, creates employment and income for people. Without income, we shall have nothing to save and nothing to spend on the consumption of goods and services.

EVALUATION

- How is the national income of a country determined?

- Explain two ways by which members of household dispose of their income

EQUATION AND CALCULATION OF INCOME DETERMINATION

CONTENTS

- Y = C + I + a + (x – m)

- Calculation of APS

- Calculation of APC

- Calculation of MPS

- Calculation of MPC

NATIONAL INCOME AND ITS CALCULATION

In calculating the National Income for an open economy where import and export are involved (International Trade). A function such as:

Y = c + 1 + a + (x-m) could be used in arriving at the aggregate income in this function.

Y = The value of national income

C = Aggregate Investment expenditure (consumption)

I = Private Investment expenditure

X = Export expenditure

M = Import expenditure

Xn = Net exports (Xn >0)

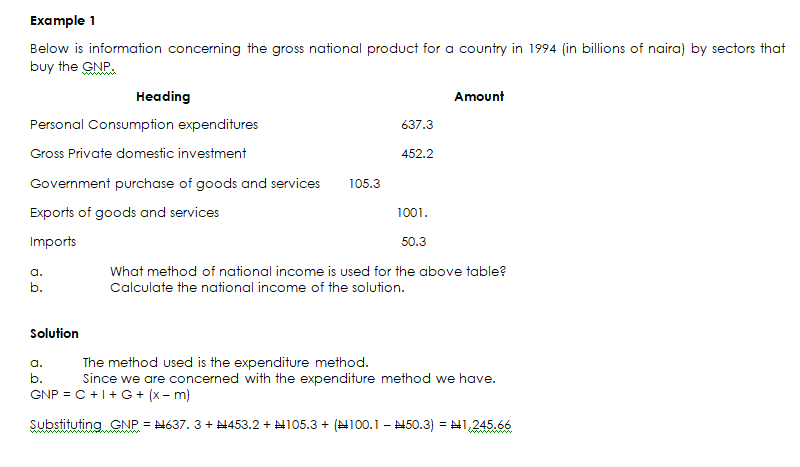

Example 1

Below is information concerning the gross national product for a country in 1994 (in billions of naira) by sectors that buy the GNP.

Heading Amount

Personal Consumption expenditures 637.3

Gross Private domestic investment 452.2

Government purchase of goods and services 105.3

Exports of goods and services 1001.

Imports 50.3

- What method of national income is used for the above table?

- Calculate the national income of the solution.

Solution

- The method used is the expenditure method.

- Since we are concerned with the expenditure method we have.

GNP = C + I + G + (x – m)

Substituting GNP = N637. 3 + N453.2 + N105.3 + (N100.1 – N50.3) = N1,245.66

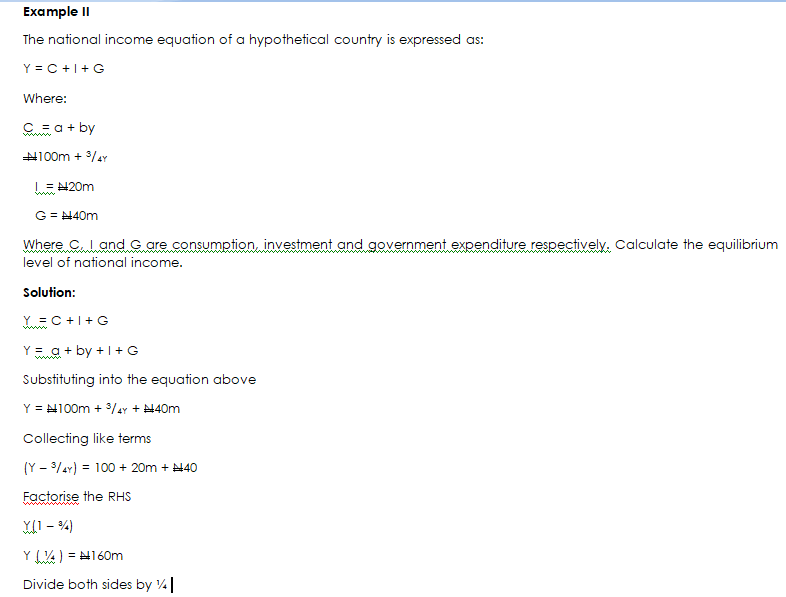

Example II

The national income equation of a hypothetical country is expressed as:

Y = C + I + G

Where:

C = a + by

N100m + 3/4Y

I = N20m

G = N40m

Where C, I and G are consumption, investment and government expenditure respectively. Calculate the equilibrium level of national income.

Solution

Y = C + I + G

Y = a + by + I + G

Substituting into the equation above

Y = N100m + 3/4Y + N40m

Collecting like terms

(Y – 3/4Y) = 100 + 20m + N40

Factorise the RHS

Y(1 – ¾)

Y ( ¼ ) = N160m

Divide both sides by ¼

Y / ¼ 160

¼ = ¼

Y = 160 x 4/1 = N640m

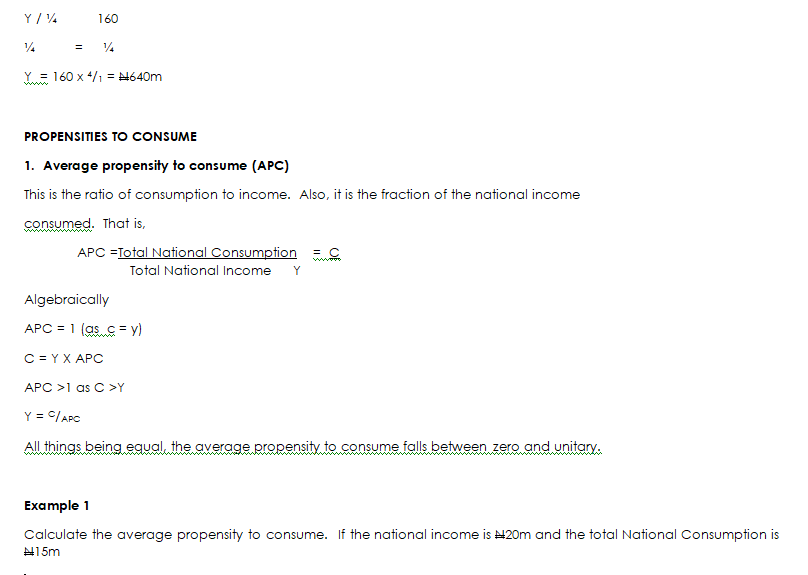

PROPENSITIES TO CONSUME

- Average propensity to consume (APC)

This is the ratio of consumption to income. Also, it is the fraction of the national income

consumed. That is,

APC =Total National Consumption = C

Total National Income Y

Algebraically

APC = 1 (as c = y)

C = Y X APC

APC >1 as C >Y

Y = C/APC

All things being equal, the average propensity to consume falls between zero and unitary.

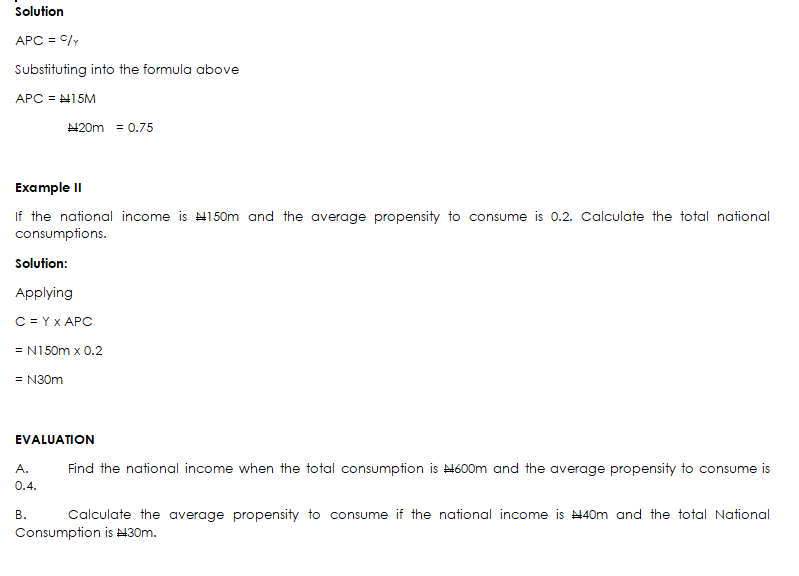

Example 1

Calculate the average propensity to consume. If the national income is N20m and the total National Consumption is N15m

Solution

APC = C/Y

Substituting into the formula above

APC = N15M

N20m = 0.75

Example II

If the national income is N150m and the average propensity to consume is 0.2. Calculate the total national consumptions.

Solution:

Applying

C = Y x APC

= N150m x 0.2

= N30m

EVALUATION

- Find the national income when the total consumption is N600m and the average propensity to consume is 0.4.

- Calculate the average propensity to consume if the national income is N40m and the total National Consumption is N30m.

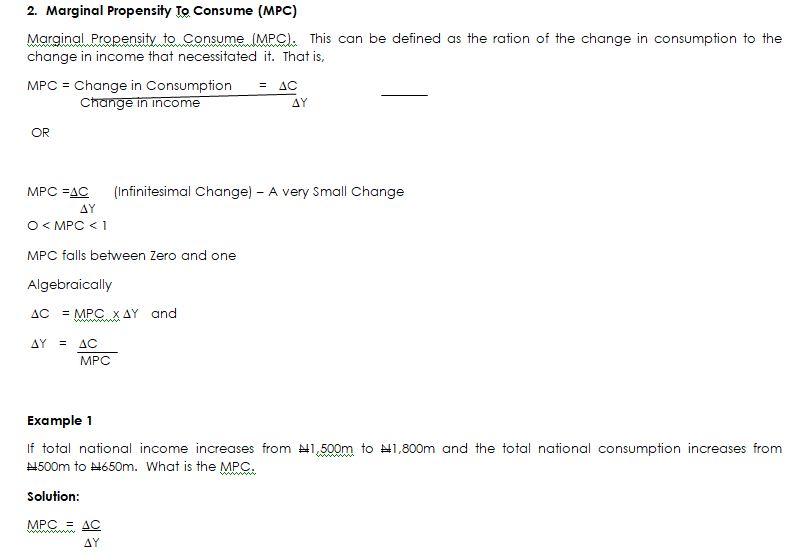

- Marginal Propensity To Consume (MPC)

Marginal Propensity to Consume (MPC). This can be defined as the ration of the change in consumption to the change in income that necessitated it. That is,

MPC = Change in Consumption = ∆C

Change in income ∆Y

OR

MPC =∆C (Infinitesimal Change) – A very Small Change

∆Y

O < MPC < 1

MPC falls between Zero and one

Algebraically

∆C = MPC x ∆Y and

∆Y = ∆C

MPC

Example 1

If total national income increases from N1,500m to N1,800m and the total national consumption increases from N500m to N650m. What is the MPC?

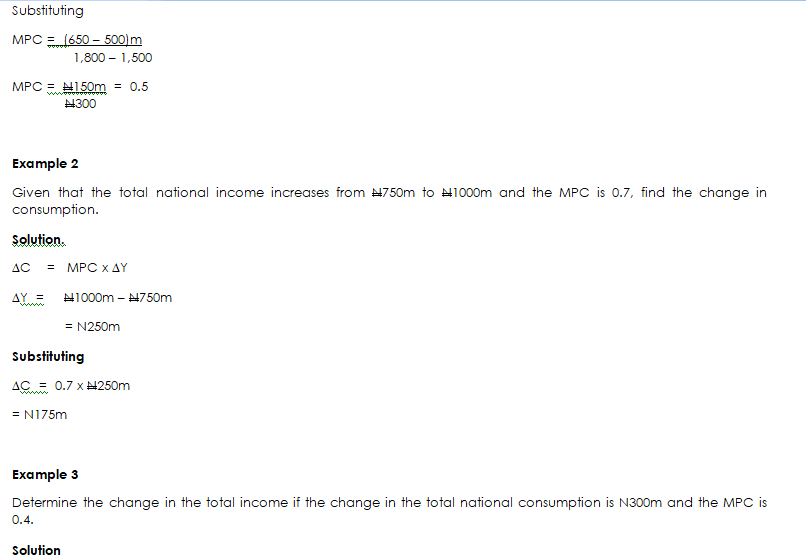

Solution:

MPC = ∆C

∆Y

Substituting

MPC = (650 – 500)m

1,800 – 1,500

MPC = N150m = 0.5

N300

Example 2

Given that the total national income increases from N750m to N1000m and the MPC is 0.7, find the change in consumption.

Solution.

∆C = MPC x ∆Y

∆Y = N1000m – N750m

= N250m

Substituting

∆C = 0.7 x N250m

= N175m

Example 3

Determine the change in the total income if the change in the total national consumption is N300m and the MPC is 0.4.

Solution

Applying

∆Y = ∆C = N300m = N750m

MPC 0.4

EVALUATION

- If total national income increases from N2,500m to N2.800m and the total national consumption increases from N700 to N950m. What is the mpc.

- Determine the change in the total national income if the change in the total national consumption is N600m and the mpc is 0.8

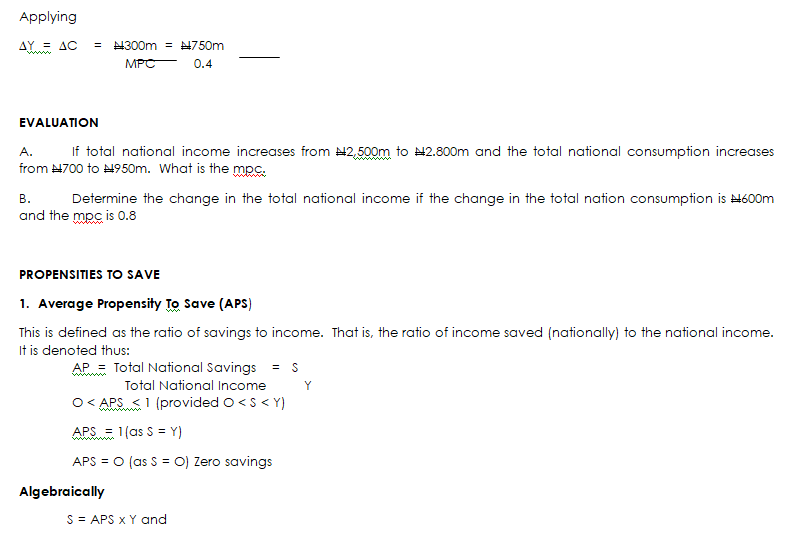

PROPENSITIES TO SAVE

- Average Propensity To Save (APS)

This is defined as the ratio of savings to income. That is the ratio of income saved (nationally) to the national income. It is denoted thus:

AP = Total National Savings = S

Total National Income Y

O < APS < 1 (provided O < S < Y)

APS = 1(as S = Y)

APS = O (as S = O) Zero savings

Algebraically

S = APS x Y and

Y = S

APS

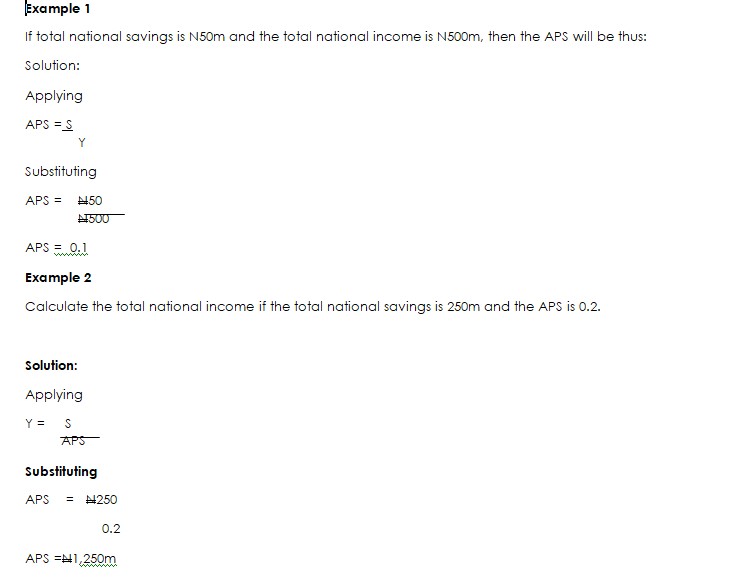

Example 1

If total national savings is N50m and the total national income is N500m, then the APS will be thus:

Solution:

Applying

APS = S

Y

Substituting

APS = N50

N500

APS = 0.1

Example 2

Calculate the total national income if the total national savings is 250m and the APS is 0.2.

Solution:

Applying

Y = S

APS

Substituting

APS = N250

0.2

APS =N1,250m

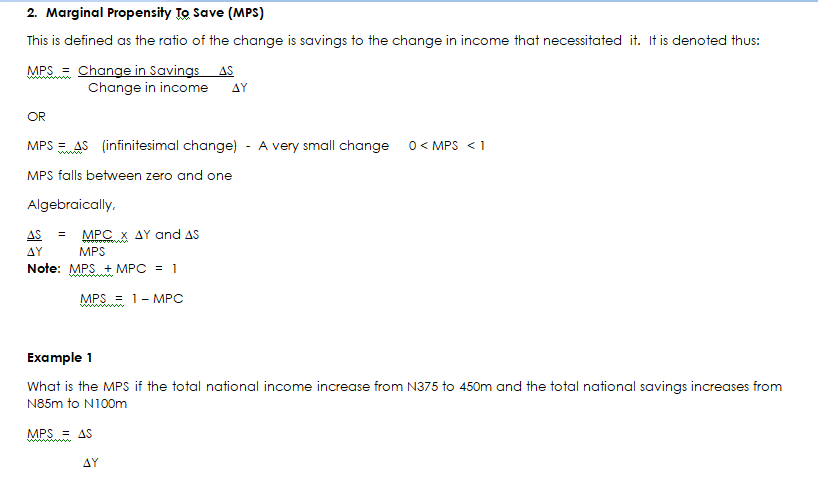

- Marginal Propensity To Save (MPS)

This is defined as the ratio of the change is savings to the change in income that necessitated it. It is denoted thus:

MPS = Change in Savings ∆S

Change in income ∆Y

OR

MPS = ∆S (infinitesimal change) – A very small change 0 < MPS < 1

MPS falls between zero and one

Algebraically,

∆S = MPC x ∆Y and ∆S

∆Y MPS

Note: MPS + MPC = 1

MPS = 1 – MPC

Example 1

What is the MPS if the total national income increase from N375 to 450m and the total national savings increases from N85m to N100m

MPS = ∆S

∆Y

Substituting

MPS = (100 – 85)

450 – 375

MPS = N15m = 0.2

N75m

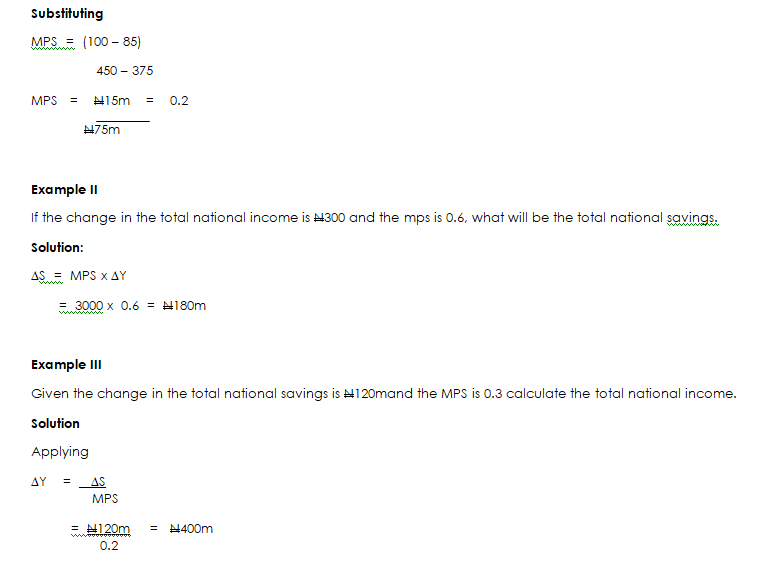

Example II

If the change in the total national income is N300 and the mps is 0.6, what will be the total national savings?

Solution:

∆S = MPS x ∆Y

= 3000 x 0.6 = N180m

Example III

Given the change in the total national savings is N120m and the MPS is 0.3 calculate the total national income.

Solution

Applying

∆Y = ∆S

MPS

= N120m = N400m

0.2

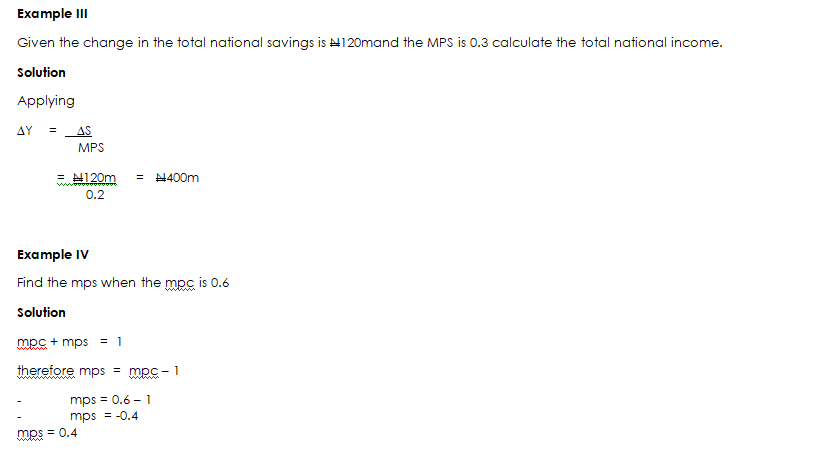

Example IV

Find the mps when the mpc is 0.6

Solution

mpc + mps = 1

therefore mps = mpc – 1

- mps = 0.6 – 1

- mps = -0.4

mps = 0.4

In our next class, we will be talking about the Theory of Multiplier. We hope you enjoyed the class.

Should you have any further question, feel free to ask in the comment section below and trust us to respond as soon as possible.

Thanks 😊 very much but I’m still finding it difficult to understand this national income determination 😔😔