Back to: FINANCIAL ACCOUNTING SS1

Welcome to class!

In today’s class, we will be talking more about the bank reconciliation statement. Enjoy the class!

Bank Reconciliation Statement II

CONTENTS

- STAGES OF BANK RECONCILIATION

- WORKING EXERCISES

- ADVANTAGES/PURPOSE OF BANK RECONCILIATION

When the entries on a bank statement are compared to those in the bank account in the cash book it will be found that they are recorded on opposite sides of the account.

It is important to compare the Bank Statement and the bank account in the Cash Book. The balance on the bank account may not agree with the balance on the Bank Statement at any particular date.

When the balances in the Cash Book and Bank Statement do not agree, it is necessary to reconcile them to explain why the difference has arisen. The bank reconciliation will show the correct balance to be used as the figure for cash at the bank.

How to prepare a bank reconciliation statement

Step 1:

Compare the entries in the bank account in the Cash Book with the Bank Statement. The debit side of the bank account should be compared with the credit side of the Bank Statement and the credit side of the bank account compared with the debit side of the Bank Statement. Put a tick ( ) against those items that appear in both the Cash Book and the Bank Statement.

Step 2:

Update the Cash Book (i.e. prepare an Adjusted Cash Book)

- Enter in the Cash Book any item which appear on the Bank Statement but which have not yet been entered in the Cash Book.

- Correct any error in the Cash Book

- Balance the Cash Book and carry down the balance.

N.B: This new Cash Book balance is the correct bank balance. If it is the end of the financial year, this is the balance which should appear in the Balance Sheet.

Step 3:

Prepare a Bank Reconciliation Statement.

This should show why the balance on the up-dated Cash Book does not agree with the balance shown on the Bank Statement.

- Start with the balance as per Adjusted Cash Book

- Add the unpresented cheques

- Deduct the uncredited cheques

- Make any adjustment for bank errors by adding amounts credited in error by the bank and deducting amounts debited in error by the bank

- The total of this calculation above should be equal to the balance as per the Bank Statement

N.B: It is possible to start the bank reconciliation statement with the balance as per the Bank Statement. In this case, it is necessary to reverse the items (b), (c) and (d) listed above.

A bank reconciliation statement does not form part of the double-entry records of the business. It is a statement which shows that, on a certain date, the bank account and the bank statement were reconciled.

Evaluation

- State five items of information given in a bank statement

- What Is the purpose of the bank reconciliation

Illustration

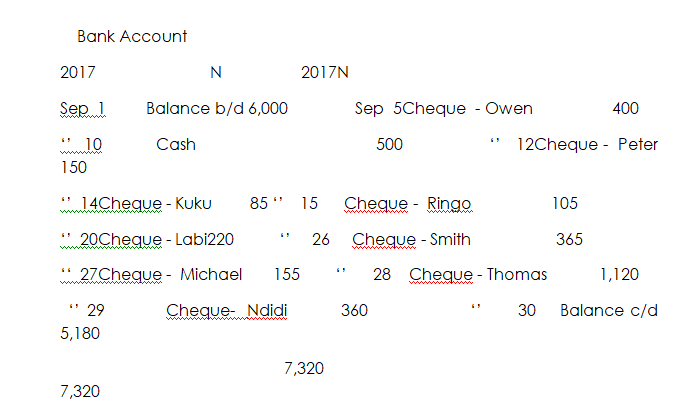

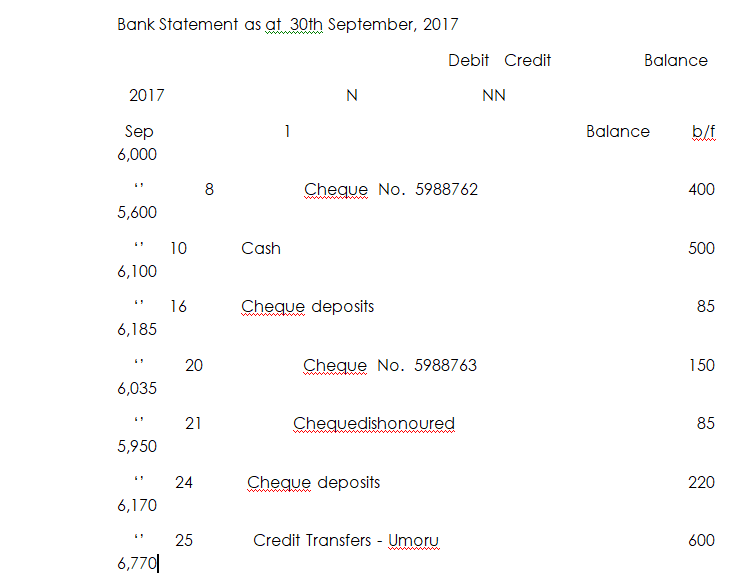

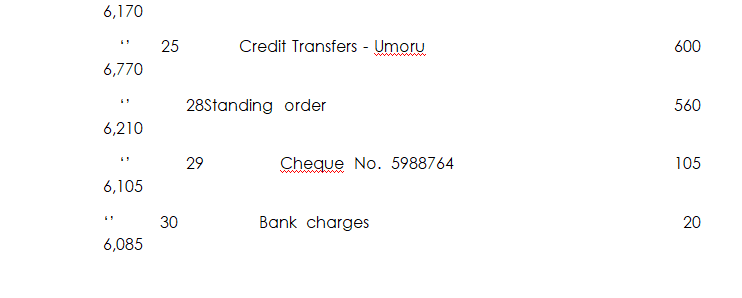

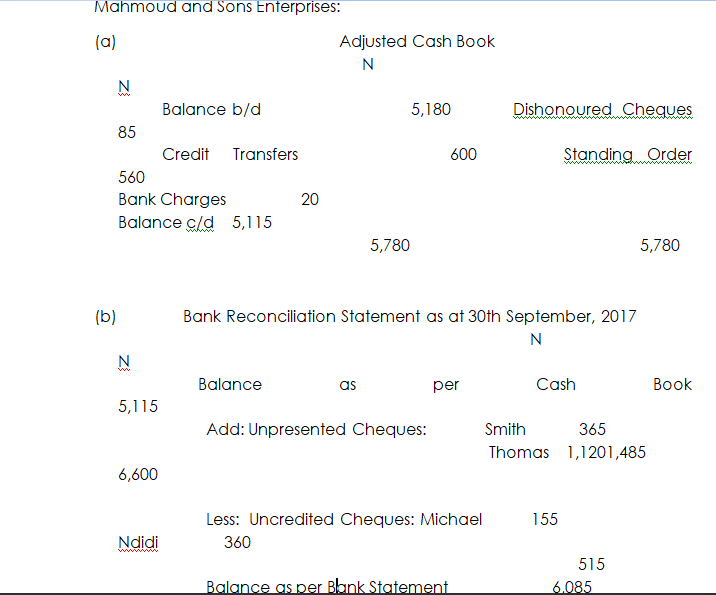

The following Bank Account and Bank Statement relate to the firm of Mahmoud and Sons Enterprises for the period 1st to 30th September 2017.

You are required to prepare:

- Adjusted Cash Book

- Bank Reconciliation Statement for the month of September 2017

Solution

Advantages / purpose / uses of bank reconciliation

- It reveals items that cause the discrepancy (disagreement) between the Cash Book balance and the Bank Statement balance

- It harmonizes (reconciles or agrees)the balances of the Cash Book and the Bank Statement

- After updating the Cash Book, an accurate bank balance is available

- It enables a customer to update his Cash Book regarding those items debited or credited in the Bank Statement which have not been entered in the Cash Book

- Unpresented cheques and uncredited cheques will be identified

- It assists in discovering fraud and embezzlement either from the bank or office

- It helps to identify errors in the Cash Book (bank account) and in the Bank Statement

- Any stale cheque (cheques over six months old, which will not be paid by the bank )can be identified and written back into the bank account

- Where the bank reconciliation statement is prepared regularly, (especially by somebody other than the cashier), it helps to reduce /prevent/deter fraud

- It ensures that the correct bank balance is shown in the Balance Sheet i.e. it reveals the correct amount of cash at bank

- Bank reconciliation is an important system of control:

- Unintended overdrawing on the bank account can be avoided

- A surplus of cash at the bank can be highlighted and invested to earn interest.

Evaluation

- What is the difference between a bank statement and a bank reconciliation statement

- List five features of a cheque

Reading assignment

- Simplified and Amplified Financial Accounting Page 95 – 114

- Business Accounting 1 Page 209 – 225

General evaluation

- List four ledger accounts that have credit balances

- State five reasons for keeping accounting records

- List eight books of account that are used in keeping account records

- State four features of the Cash Book

- State four differences between trade discounts and cash discounts

Weekend assignment

- Which of the following does not appear in a bank statement (a) dividends received (b) bank charges (c) uncredited cheques (d) dishonoured cheques

Use the following information to answer questions 2 and 3

. N

Balance as per Cash Book 18,000

Dishonoured Cheques 1,200

Bank Charges 300

Unpresented Cheques 2,400

- The Adjusted Cash Book balance is (a) N18,900 (b) N18,000 (c) N17,700 (d) N16,500

- The balance as per Bank Statement is (a) N21,300 (b) N18,900 (c) N16,500 (d) N14,100

- A bank statement shows an overdraft of N190,000. Kofi, a debtor, paid N400,000 into the account. The new bank balance is (a) N590,000 (b) N590,000 overdrawn (c) N210,000 (d) N210,000 overdrawn

- Unpresented cheques are cheques (a) that have been received by the bank, but not recorded in the Cash Book (b) returned by the bank (c) that have been recorded in the Cash Book but not by the bank (d) written, but not handed over to customers.

Theory

- State five reasons for preparing a bank reconciliation statement

- List seven items that are added to the balance as per Bank Statement in the preparation of the bank reconciliation statement

In our next class, we will be talking about Final Accounts of a Sole Trader. We hope you enjoyed the class.

Should you any further question, feel free to ask in the comment section below and trust us to respond as soon as possible.

Good