Back to: FINANCIAL ACCOUNTING SS1

Welcome to class!

In today’s class, we will be talking more about the final accounts of a sole trader. Enjoy the class!

Final Accounts of a Sole Trader II

CONTENT :

- The Trading, Profit and Loss Account

- The Balance Sheet

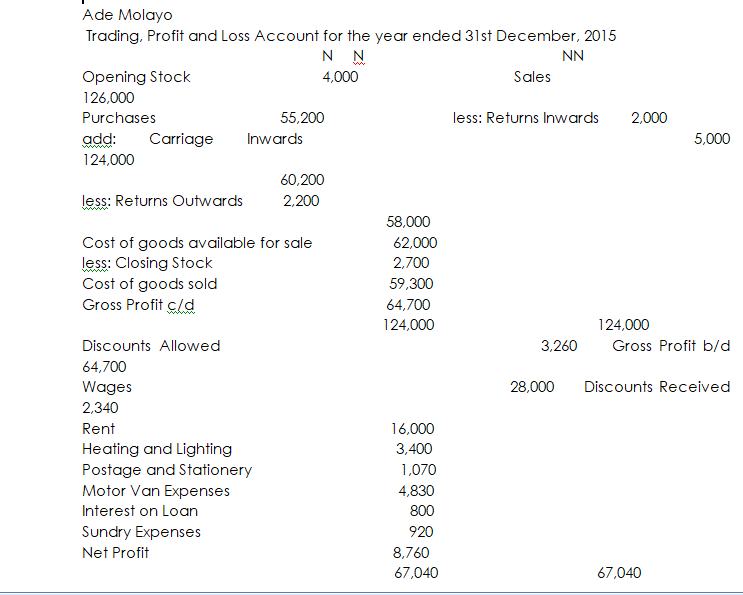

The Trading Account and the Profit and Loss Account are usually combined to form a continuous statement.

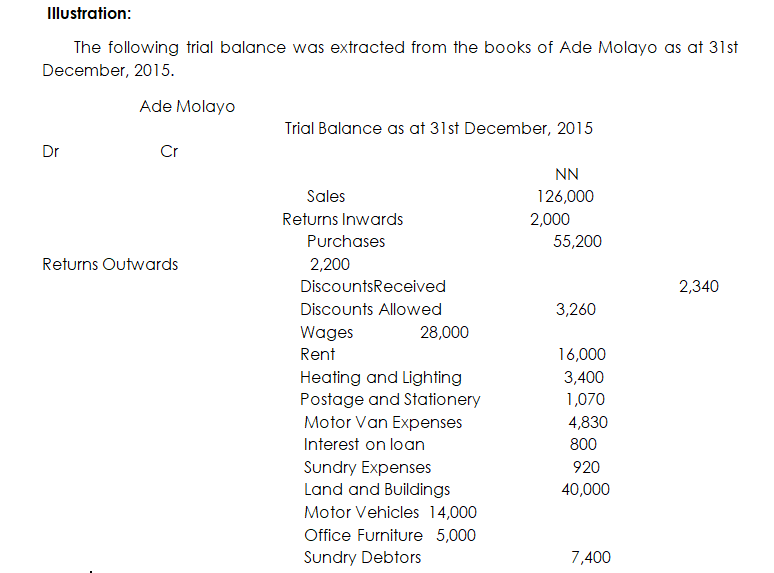

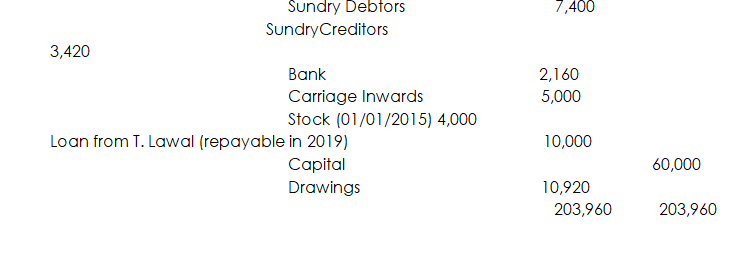

Both the Trading, Profit and Loss Account and the Balance Sheet are referred to as Financial Statements. Financial Statements are usually prepared from a Trial Balance. Every item in a trial balance appears once in a set of financial statement. As each item is used, it is useful to place a tick ( )against the item. This ensures that no items are overlooked.

It is also common to find notes (or additional information) accompanying a trial balance about various adjustments which are to be made in preparing the financial statements. Any note to a trial balance is used twice in a set of financial statements. To ensure that this is done, it is useful to place a tick ( ) against the notes each time they are used.

It must be emphasized that the Trading Account and the Profit and Loss Account are both parts of the double-entry system. Therefore any item that is debited or credited either in the Trading Account or the Profit and Loss Account must have a corresponding double entry in another ledger account.

The items appearing in the Trading, Profit and Loss Account are the ledger account balances which are transferred by means of Journal entries. The student is not usually required to prepare the Journal entries in examination questions.

Additional Information:

- Stock on 31st December 2015 was N 2,700

Required: Prepare Ade Molayo’s Trading, Profit and Loss Account for the year ended 31st December 2015.

- It should be noticed that not all the items in the Trial Balance have been used in preparing the Trading, Profit and Loss Account. The remaining balances (i.e. the items that are yet to be ticked in the Trial Balance) are assets, liabilities or capital. These will be used later when a Balance Sheet is drawn up.

Evaluation

- Explain the following: (a) cost of goods available for sale (b) cost of goods sold (c) financial statements

- Describe three features of each of the following financial statements:

- Trading Account

- Profit and Loss Account

Reading assignment

- Simplified and Amplified Financial Accounting Page 180 – 187

- Business Accounting 1 Page 49 – 57

General evaluation

- Business Accounting 1, Exercise 6.1, 6.2, 6.3A, 6.4A

- Simplified and Amplified Financial Accounting Question 4 Page 187

Weekend assignment

- When the cost of goods sold is added to closing stock, the resulting figure is (a) carriage inwards (b) cost of sales (c) gross profit (d) cost of goods available for sale

- Which of the following is not found in a trial balance (a) opening stock (b) closing stock (c) capital (d) rent paid

- A statement that measures the performance of a business over a period of time is the (a) Balance Sheet (b) Bank Statement (c) Profit and Loss Account (d) Bank Reconciliation Statement

- The effect on profit when closing stock is understated is (a) increase in profit (b) decrease in profit (c) no change in profit (d) a doubling of profit

- Carriage outwards expenses of a business are treated in the (a) Balance Sheet (b) Income Surplus Account (c) Profit and Loss Account (d) Trading Account

Theory

- List three uses of the Profit and Loss Account

- State four differences between the Trading Account and the Profit and Loss Account.

In our next class, we will be talking about the Balance Sheet. We hope you enjoyed the class.

Should you any further question, feel free to ask in the comment section below and trust us to respond as soon as possible.