Back to: FINANCIAL ACCOUNTING SS1

Welcome to class!

In today’s class, we will be talking about the double-entry principle. Enjoy the class!

Double Entry Principle

By the end of the lesson, you should be able to;

- State original accounting equation and re organize it

- Identify and apply the double entry principle in posting a business transaction

- Paraphrase the meaning of source document

Note

The day-to-day transactions of a business are recorded in the books of account using the double-entry system of bookkeeping. The term double entry is used because the two effects of a transaction (a giving and a receiving) are both recorded in the ledger.

Double-entry bookkeeping is the system of keeping account which involves the recording of the two-fold aspect of every transaction, whereby one account that receives value is debited and another account, which gives value is credited.

Rules of double entry

- All transactions must be recorded in two accounts, one account is debited and another account credited.

- For every debit entry in an account, there must be a corresponding credit entry in another account.

- For every credit entry in an account, there must be a corresponding debit entry in another account.

- Debit the account that receives value, credits the account that gives values.

Illustration

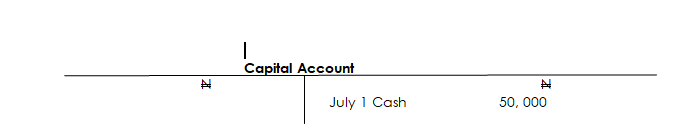

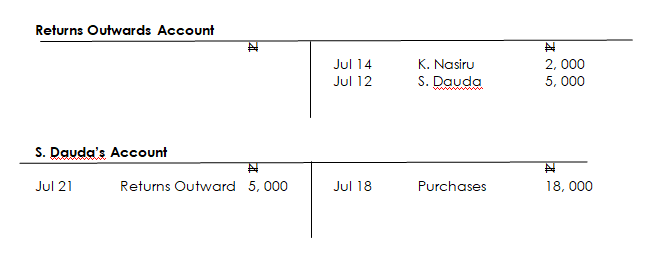

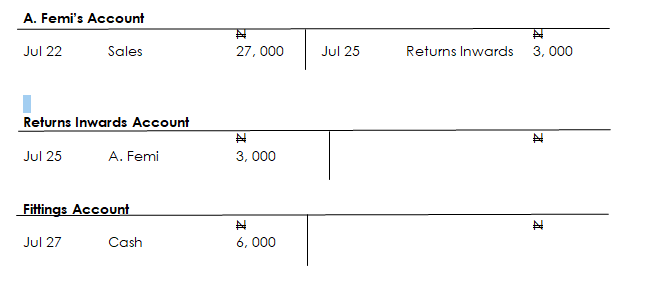

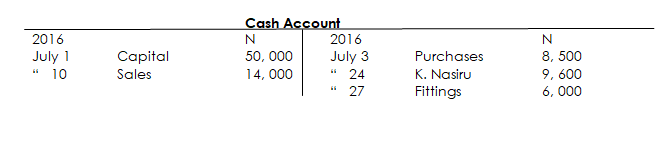

Record the following transaction in the ledger of F. Sanusi for the month of July 2016.

July 1 Started business with N50, 000 cash

“ 3 Bought goods for cash N8, 500

“ 7 Bought goods on credit N11, 600 from K. Nasiru

“ 10 Sold goods for cash N14, 000

“ 14 Returned goods to K. Nasiru N2, 000

“ 18 Bought goods on credit N18, 000 from S. Dauda.

“ 21 Returned goods to S. Dauda N5, 000

“ 22 Sold goods to A. Femi N27, 000 on credit

“ 24 Paid K. Nasiru’s account by cash N9, 600

“ 25 A. Femi returned goods worth N3, 000 to us

“ 27 Bought ceiling fan for the shop by cash N6, 000

Solution

A business maintains a separate ledger account for each type of asset, liability, expense and income and also for each individual debtor and creditor. Every transaction is recorded in the ledger account relating to that particular item or person.

In practice, each ledger account has its own page or sheet (i.e. folio). As this is not possible in examination questions and class exercises, it is usual to find several accounts displayed on one page.

Evaluation

- Complete the following table, showing the accounts to be debited and those to be credited:

- Bought furniture by cheque

- Paid wages by cash

- Cash sales

- Cash purchases

- Started business with money in the bank

- The owner took cash for his personal use

- Sold goods on credit to Mr Anayo

- Bought fixtures on credit from Odunlade

- Bought machinery by cheque

- Received loan by cash from Mr Evans

Business Accounting 1 by Frank Wood, Exercise 3.6, 3.9A and 3.10A

Reading assignment

- Simplified and Amplified Financial Accounting page 20 – 27

- Business Accounting 1 page 21 – 38

General evaluation

- State four differences between bookkeeping and accounting.

- List ten users of financial information.

- State seven benefits of keeping accounting records.

- List three differences between the Journal and the Ledger.

- Explain the principle of the double-entry system

Weekend assignment

- Cross-referencing among different books of account is achieved with the use of columns B. reference numbers C. folio D. margin

- A ledger is a summary of entries B. book of original entry C. book of account D. double entry posting

- A trader set aside from his private funds N70, 000 for business purposes. The N70, 000 would be referred to as drawings B. profit C. capital D. loan

- Purchases in accounting refer to goods bought for repairs B. permanent use C. resale D. owner’s use

- When goods are sold for cash, the credit entry goes to the ___? A. trader’s account cash account C. customer’s account D. sales account

Theory

- What is a ledger?

- Explain the principle of the double-entry system.

In our next class, we will be talking about Balancing of Ledger Accounts. We hope you enjoyed the class.

Should you any further question, feel free to ask in the comment section below and trust us to respond as soon as possible.

This website is very amazing and helpful to me. I learnt a lot and I also got a good and deeper understanding of Accounting.

I am going back now to revise all what I’ve been taught in class and all I have learnt now.

We’re glad you found it helpful😊 For even more class notes, engaging videos, and homework assistance, just download our Mobile App at https://play.google.com/store/apps/details?id=com.afrilearn. It’s packed with resources to help you succeed🌟

I love and understood every section of this class and I will like other students like me to learn more for the future.

We’re glad you found it helpful😊 For even more class notes, engaging videos, and homework assistance, just download our Mobile App at https://play.google.com/store/apps/details?id=com.afrilearn. It’s packed with resources to help you succeed🌟

this was helpful 😌

this was helpful 😌 thanks 😊

this was helpful 😌 thanks 😊 a lot

this was helpful 😌 thanks 😊 a lot

❤😘