Back to: COMMERCE SS2

Welcome to SS2 Third Term!

We are eager to have you join us in class!!

In today’s Commerce class, We will be discussing Capital. We hope you enjoy the class!

TOPIC: CAPITAL

CONTENT

- Definition

- Types (forms) of capital

- Importance of Working Capital

- Calculation of types of Capital

CAPITAL

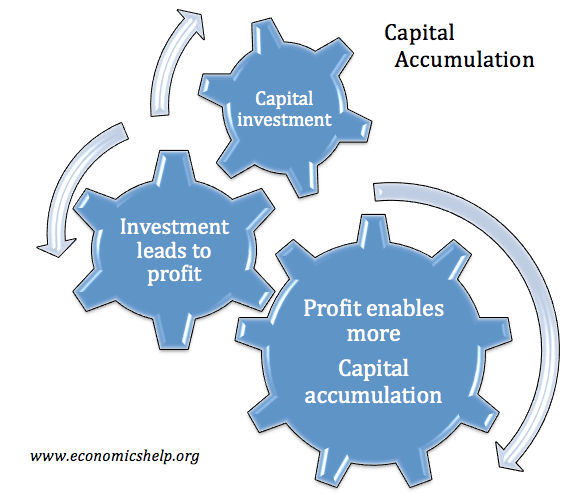

Capital in business refers to all the assets and property of a firm.

TYPES OF CAPITAL

- FIXED CAPITAL: This refers to the assets of a firm which the business is carried on, and which are used continuously in the process of earning income e.g. Buildings, machinery fixtures and fittings

- CIRCULATING OR FLOATING CAPITAL: This is the capital which is required regularly for production and which is always changing as the business operates e.g. raw materials finished goods (i.e. stock, cash, debtors etc).

- LIQUID CAPITAL: This is made up of cash-in-hand, debtors and bank balances of a firm. These are liquid assets because they can easily be converted into cash.

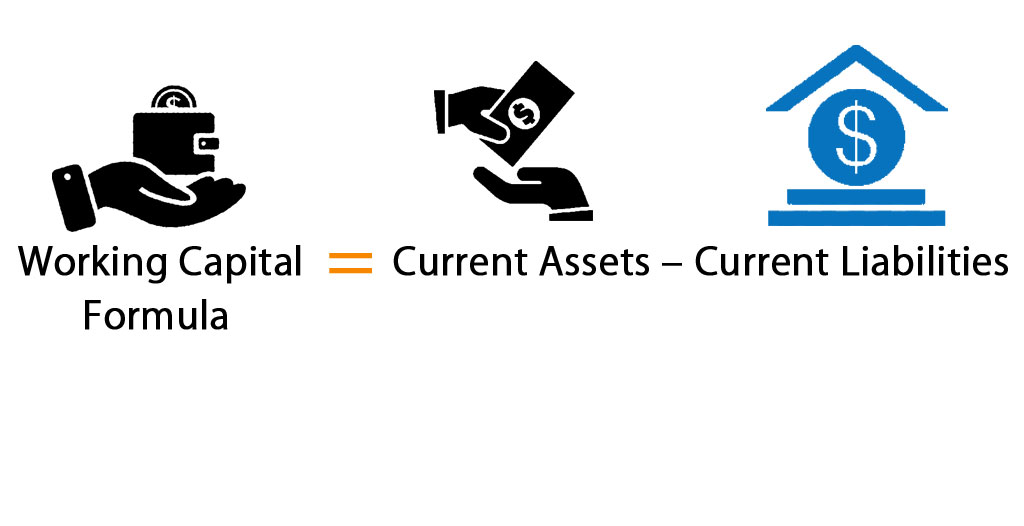

- WORKING CAPITAL: This is the excess of the current assets over the current liabilities. In calculating working capital, therefore, the current liabilities are subtracted from the current assets.

- CAPITAL EMPLOYED: This is the amount of capital invested by the owner or owners into the business and is calculated by subtracting current liabilities from the total assets.

IMPORTANCE OF WORKING CAPITAL

- Working capital helps to determine the liquidity position of an organization.

- It determines the fund available for the day to day running of the business.

- Since it is used to purchase stock for sale more working capital indicates a higher profit.

- It checks against tying down of capital.

- It is used to determine the solvency of the organization.

- It indicates that the organization is not relying on finances from suppliers.

REVIEW QUESTIONS

- Explain what is meant by

(a) Working Capital (b) Capital Employed

- How is each of the above calculated?

TYPES OF CAPITAL (contd.)

- OWNERS EQUITY OR NET WORTH OR CAPITAL OWNED: This refers to the excess of total assets over liabilities i.e. excess of fixed and current assets over total liabilities (long term and current liabilities).

- LOAN CAPITAL OR CAPITAL BORROWED: This refers to long-term liabilities. For example debenture stocks long term loans from banks repayable after one year.

- RESERVE CAPITAL: This is the part of issued capital not yet called-up. It is also known as uncalled capital. Reserve Capital = Issued Capital – Paid Up Capital

- Nominal or Authorized Capital: This is the maximum amount of capital which a company is authorized to raise as stated in its memorandum of Association .it is also referred to as nominal capital or registered capital

- Issued capital: This is that part of the authorized capital that has been issued to shareholders for subscriptions. It may be the same or less than the authorized capital.

GENERAL SELF EVALUATION QUESTIONS

- State five function of the Nigerian Export Promotion Council

- Describe five ways by which commercial banks aid international trade

- State five reasons why road transport would be preferred to rail transport

- Give seven functions of the Federal Airports Authority of Nigeria (FAAN)

- State five aids to trade and explain how each facilitates trade.

We have come to the end of this class. We do hope you enjoyed the class?

Should you have any further question, feel free to ask in the comment section below and trust us to respond as soon as possible.

In our next class, we will be talking about Capital II. We are very much eager to meet you there.