Back to: BUSINESS STUDIES JSS1

Welcome to class!

In today’s class, we will be talking about the introduction to bookkeeping. Enjoy the class!

Introduction to Bookkeeping

What is bookkeeping?

Bookkeeping is the act of systematic keeping of a daily adequate financial record of all transactions of a business. It involves the recording, daily, of a company’s financial transactions. With proper bookkeeping, companies can track all information on its books to make key operating, investing, and financing decisions.

Bookkeepers are individuals who manage all financial data for companies. Without bookkeepers, companies would not be aware of their current financial position, as well as the transactions that occur within the company.

Importance of bookkeeping

- Individual and firm are made to know how to spend money prudently,

- It creates employment opportunity in the area of accounting.

- It prevents fraud by dishonest staff.

- Individual, businessperson are helped by it to remember all items bought or sold in connection with the business.

- It enables an individual or firm to be aware of the true financial position of its business.

Common bookkeeping practices

These are the steps taken by the bookkeeper before the accountant then takes over. These steps or practices undertaken by the bookkeeper include:

- Posting of transaction ledgers.

- Preparing of subsidiary books.

- Extracting the trials balance from the ledgers.

- Classifying source documents.

Common bookkeeping ethics

- Hard work

- Loyalty

- Objectivity

- Integrity

- Current and up-to-date

Types of bookkeeping

The following are the types of bookkeeping:

- Double-entry system

- Single-entry system

- Virtual bookkeeping

- Bookkeeping software.

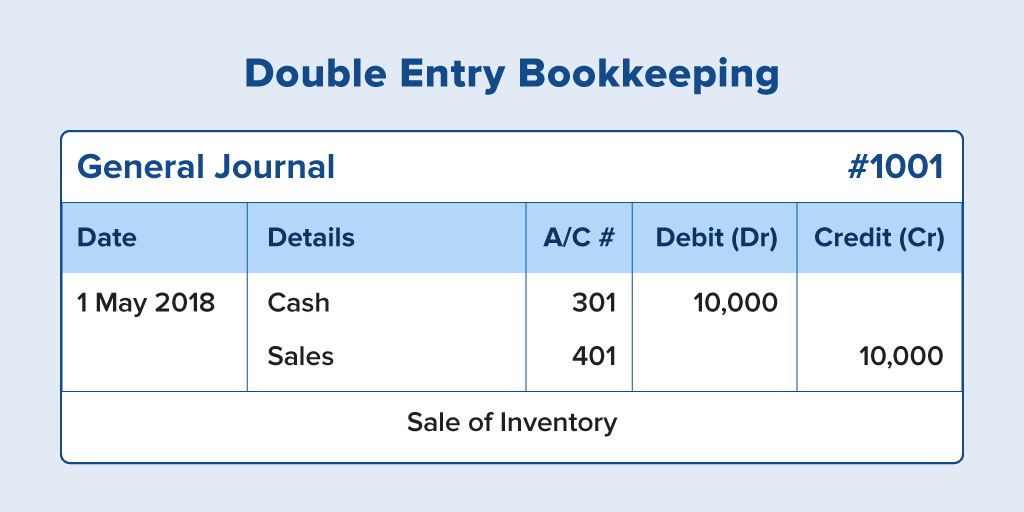

Double-entry system:

Double-entry bookkeeping systems are used for businesses that routinely have more complex transactions. Companies that collect income through accounts receivable and receive merchandise and inventory on credit are better-suited for this method. This system posts single transactions as an income or expense item then create a second entry to trace the transaction to a corresponding account.

For example, if you receive income from a customer, the revenue is posted as income and also traced to the customer’s account. In the event you are audited or need to know where income and expense payments generated, you’ll have a paper trail to find the information quickly. This system uses debits and credits, which is the accountant’s language of increases and decreases to each account affected by your transactions.

Single-entry system:

The single-entry bookkeeping system is used for businesses that have minimal or uncomplicated transactions. This system records cash sales and business expenses that are paid when incurred. This system is not traditionally used for businesses that have accounts receivable, accounts payable or many capital transactions. Bookkeeping entries under this system don’t match transactions to corresponding accounts, which can make tracing revenues and expenses more difficult.

In essence, the single-entry system consists of a cash sales journal, a cash disbursements journal and your bank statements. An entry is made to the sales journal when revenue is received, and an entry is made to the disbursement journal when an expense is paid. Your journal entries should reconcile with your bank account transactions.

Virtual bookkeeping:

If the whole idea of a single entry and double-entry bookkeeping methods makes you queasy, you might benefit from virtual bookkeeping services. A virtual bookkeeper eliminates the need for expensive CPA fees or an in-house bookkeeping employee. Most virtual bookkeepers accept your sales invoices, expense receipts and payroll ledgers electronically. The bookkeeper posts your transactions to appropriate journals and ledgers, and emails you a copy of your reports. Virtual bookkeepers are typically CPAs or degreed accountants who tend to have lower fees than private CPA firms.

Bookkeeping software:

Many small business owners use bookkeeping software to keep track of financial activities. Programs such as Quick Books and Sage formerly Peachtree, use the double-entry bookkeeping system, but you won’t necessarily need to be well versed in the method to use the software. These programs are relatively user-friendly and prompt you to enter information to complete and post your transactions. Various versions of the software exist, ranging from basic to professional capacities, and you can purchase the software in desktop, online or cloud versions.

We hope you enjoyed the class.

Should you have any further question, feel free to ask in the comment section below and trust us to respond as soon as possible.

This wept side is awesome, appreciate the help that you all are doing to us the student, with the help of this Westside i will be able to teach to my students very well and effectively. May God bless you all.

Thanks a lot, you guys are awesome, you’re really making teaching so much easier.

GREAT 👍

GOOD 👍 👍 👍 👍 👍 👍