Back to: BUSINESS STUDIES JSS2

Welcome to Class !!

We are eager to have you join us !!

In today’s Business Studies class, We will be discussing Petty Cash Book. We hope you enjoy the class!

Petty cash book

Besides maintaining a main or general cash book, many companies also maintain a small cash book known as petty cash book to record small day to day expenditures of the business.

Petty cash book is a type of cash book that is used to record minor regular expenditures such as office teas, bus fares, fuel, newspapers, cleaning, pins, and causal labour etc. These small expenditures are usually paid using coins and currency notes rather than checks. The person responsible for spending petty cash and recording it in a petty cash book is known as a petty cashier.

Petty cash systems

The cash allocated for petty expenditures for a specific period is entered on the credit side of general cash book and on the debit side of the petty cash book.

The cash is given to the petty cashier either on the ordinary system or imprest system which are briefly explained below:

1. Ordinary system

Under the ordinary system, a lump sum amount of cash is given to the petty cashier. When the whole amount is spent, the petty cashier submits the details of petty expenditures recorded in the petty cash book to the head or chief cashier for review.

2. Imprest system

Under the imprest system, a fixed amount of money known as a float is given to the petty cashier to meet petty expenditures for an agreed period which usually consists of a week or month. At the end of the agreed period, the petty cashier submits the details of all expenditures incurred by him to the chief cashier. The total cash spent by the petty cashier during the period is reimbursed to him and the total cash available to spend at the start of the next period becomes equal to the original sum (i.e., float). At any time, the total of petty cash balance and all expenditures that have not been reimbursed to the petty cashier is equal to the agreed float.

Types of petty cash book

The petty cash book is of the following two types:

- Simple petty cash book

- Analytical petty cash book

Simple petty cash book

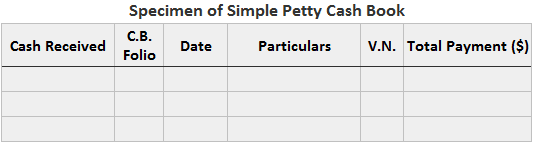

Simple petty cash book is just like the main cash book. Cash received by the petty cashier is recorded on the debit side and all payments for petty expenses are recorded on the credit side in one column.

Format of simple petty cash book

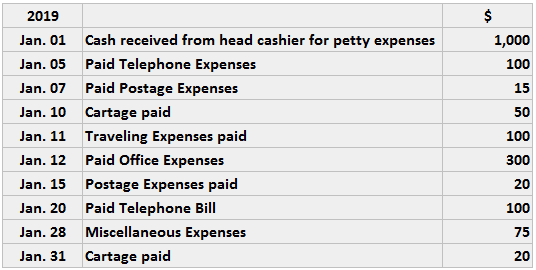

Example of a simple petty cash book

Record the following transactions in a simple petty cash book for the month of January 2019.

Solution

Analytical petty cash book

It is the most advantageous method of recording petty cash payments. In this type, a separate column for each petty expense is provided on the credit side. When a petty expense is recorded in total payment column, the same amount is recorded in the relevant petty expense column.

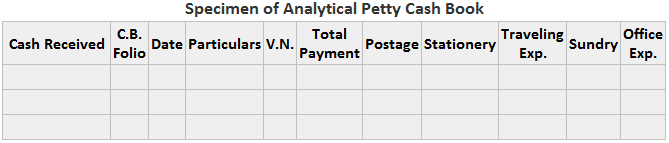

Format/specimen of analytical petty cash book

Example of analytical petty cash book

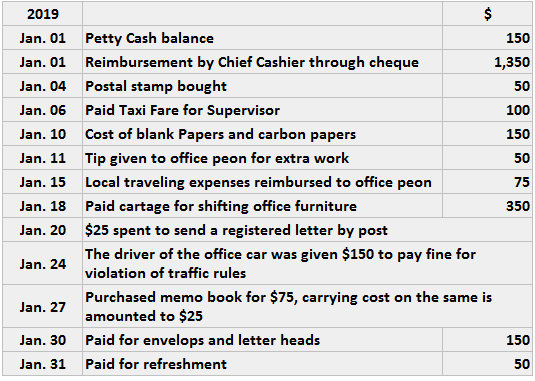

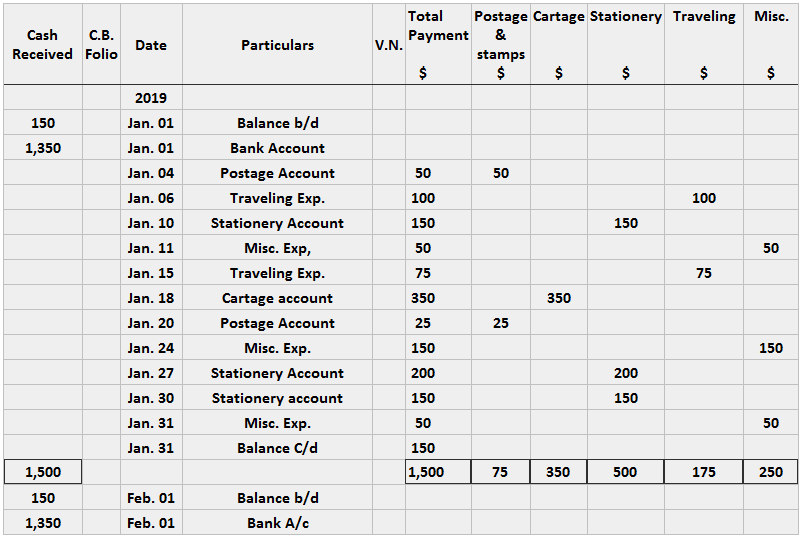

Record the following transactions in an analytical petty cash book for the month of January 2019.

Solution

The operation of petty cash

When a petty cashier needs money, he is given a cheque by the main cashier. This cheque is recorded on the payments side of the main cash book. The petty cashier gets cash against the cheque from the bank and records the cheque in the receipt’s column of the petty cash book.

When a payment is to be made out of the petty cash fund, a petty cash voucher (PCV) is prepared by the petty cashier. This voucher must be authorized by a responsible officer before the petty cashier makes the payment. Upon payment, the petty cashier records the date, details of the payment (in particulars column), PCV no., the amount of the voucher in the total payment column and also in the relevant analysis column.

We have come to the end of this class. We do hope you enjoyed the class?

Should you have any further question, feel free to ask in the comment section below and trust us to respond as soon as possible.

In our next class, we will be talking about the Cash Book. We are very much eager to meet you there.

The class was so interesting and the lessons so easy to understand.

you’re amazing tanks

I really like the class😍😍❤️❤️, it’s so interesting and understandable. Thanks

i love this. thank uu