Back to: BUSINESS STUDIES JSS2

Welcome to Class !!

We are eager to have you join us !!

In today’s Business Studies class, We will be discussing Cash Book. We hope you enjoy the class!

Cash book

Cashbook is the one in which all the cash receipts and cash payments including the funds that are deposited in the bank and funds which are withdrawn from the bank are recorded according to the date of the transaction. All the transaction which is recorded in the cash book has the two sides i.e., debit and credit.

The difference between the sum of balances of the debit side and credit side shows the balance of the cash on hand or bank account. Cashbook plays a dual role as it is the book of the original entry of the company as well as book the final entry.

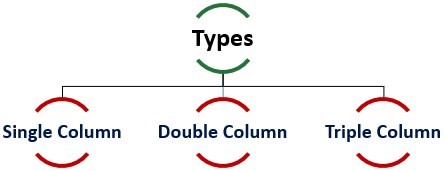

Types of cash book formats

There are three types of cash book formats which are the following:

1 – single column

Single column cash-book contains only the cash transactions done by the business. Single column cash-book has only a single money column on debit and credits both sides. It does not record the transaction-related which involves banks or discounts. The transactions which are done on credit are not recorded while preparing the single column cash –book.

2 – double column

Double column cash-book contains has two money column both on the debit side as well as the credit side. One column is for the transactions related to the cash and the other column is for the transactions related to the bank account of the business. So, under double-column cash-book, not only cash transactions but transaction through the bank is done by the business is also recorded. The transactions which are done on credit are not recorded while preparing the double column cash –book.

3 – triple column

It is also referred as three-column cash book format and it is the most exhaustive form which has three columns of money on both receipt and payment sides and record transactions pertaining to the cash, bank and the discounts. This book is maintained generally by the large firms that do transactions in cash mode as well as through the bank and frequently allows and receives cash discounts.

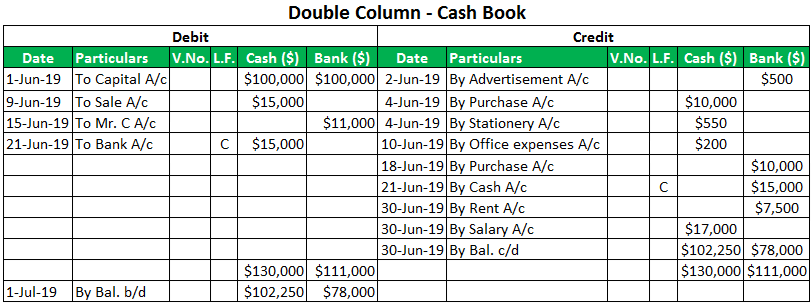

Cashbook format

Mr X started the business in the month of June-2019. He invested the capital of $200,000, in which the cash contribution is $100,000 and rest $100,000 he deposited in the business bank account. During the month of June 19, the following transactions took place in the business. Prepare the necessary double-column cash book using the data as given below:

| Date | Transactions | |

| 1-jun | Initial capital contribution. Cash: $100,000 a bank $100,000 | |

| 2-jun | Paid for advertisement $ 500 from check | |

| 4-jun | Raw material purchased from Mr A of $ 10,000 by paying cash | |

| 4-jun | Purchased stationery for cash worth $ 550 | |

| 7-jun | Raw material purchased from Mr B of $ 20,000 on credit | |

| 9-jun | Goods sold to the customer for $15,000 by cash | |

| 10-jun | Paid $ 200 for the office expenses in cash | |

| 13-jun | Goods sold on credit worth $ 11,000 to Mr C | |

| 15-jun | Received a check worth $ 11,000 for the goods sold on credit on 13-July-2019 to Mr C. | |

| 18-jul | Raw material purchased $ 10,000 by paying through check | |

| 21-jun | Withdrew from bank $ 15,000 for business | |

| 25-jun | Goods sold on credit worth $ 5,000 | |

| 30-jun | paid rent by check of $ 7,500 | |

| 30-jun | Paid the salaries to staff of $ 17,000 in cash |

Solution:

Advantages

- It helps in saving time and labour as in case of recording cash transactions in the journal, huge time and labour are required. Whereas, in the case of cashbook, cash transactions are recorded straight away that is in the form of the ledger.

- Management can know the balances of cash and bank at any time. It helps in effective cash management.

- Cashbook is balanced regularly which helps in avoiding frauds. Also, discrepancies if any arises can be found and rectified.

We have come to the end of this class. We do hope you enjoyed the class?

Should you have any further question, feel free to ask in the comment section below and trust us to respond as soon as possible.

We have come to the end of JSS2 Second term. It’s been a remarkable journey with you. We hope to see you in the Third term and can’t wait to meet you there.