Back to: BUSINESS STUDIES JSS3

Welcome to Class !!

We are eager to have you join us !!

In today’s Business Studies class, We will be discussing the Profit and Loss Account. We hope you enjoy the class!

This is an account prepared after the preparation of the Trading Account. It is debited with all operational expenses and credited with the gross profit and all other revenue accruing to a business.

Purpose of Preparing the Profit & Loss Account

The P&L account is prepared either to ascertain net profit or a net loss.

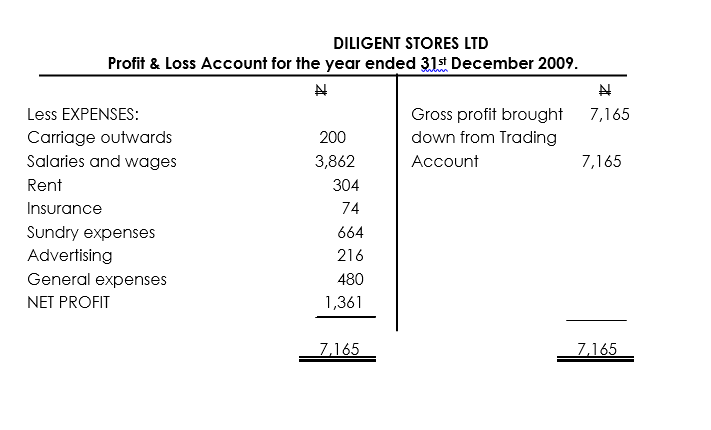

Worked Example:

Question: From the trial balance of Diligent Stores Ltd of last class, you are required to prepare the Profit and Loss Account of the company for the year ended 31st December 2009.

Solution

EVALUATION

- Write a short note on profit and loss account.

- State the purpose of preparing a profit and loss account.

READING ASSIGNMENT

Business Studies by O.A. Lawal. Pages 77 to 80

GENERAL REVISION QUESTIONS

- What is a petty cash book?

- Mention three items that can appear in the petty cash book.

- Who keeps the petty cash book?

- Define imprest system.

- What is the amount of money given to the petty cashier at the beginning of the period called?

WEEKEND ASSIGNMENT

- Which of the following is an item in the profit and loss account? A. sales B. purchases C. carriage inward D. Carriage outward.

- All of the following are expenses in the profit and loss account except__ A. discount received B. electricity discount allowed D. rent and rates.

- ____ is an item credited in profit and loss account. A. insurance B. Drawings C. Rent received D. Salaries and wages.

- The purpose of preparing profit and loss account is to ascertain the ______of the business. A. net profit /gross loss B. net income C. Gross profit /gross loss D. Net profit/ /net loss.

- In the profit and loss account, all expenses are___ A. debited B. credited C. closed down D. added to the gross profit.

THEORY

- Write short notes on the Profit and Loss account.

- Prepare a format of a Profit and Loss Account with four items on the credit side and twelve items or entries on the debit side.

We have come to the end of this class. We do hope you enjoyed the class?

Should you have any further question, feel free to ask in the comment section below and trust us to respond as soon as possible.

In our next class, we will be talking about the Procedure for making payment and Receipt. We are very much eager to meet you there.

This was really helpful thanks so much